Electrical & Electronics

Overview of E & E sector

Malaysia’s E&E sector is a diverse and wide-reaching area of the economy. Analysis of the end-to-end value chain was undertaken across three key perspectives in order to form a holistic assessment of its operations.

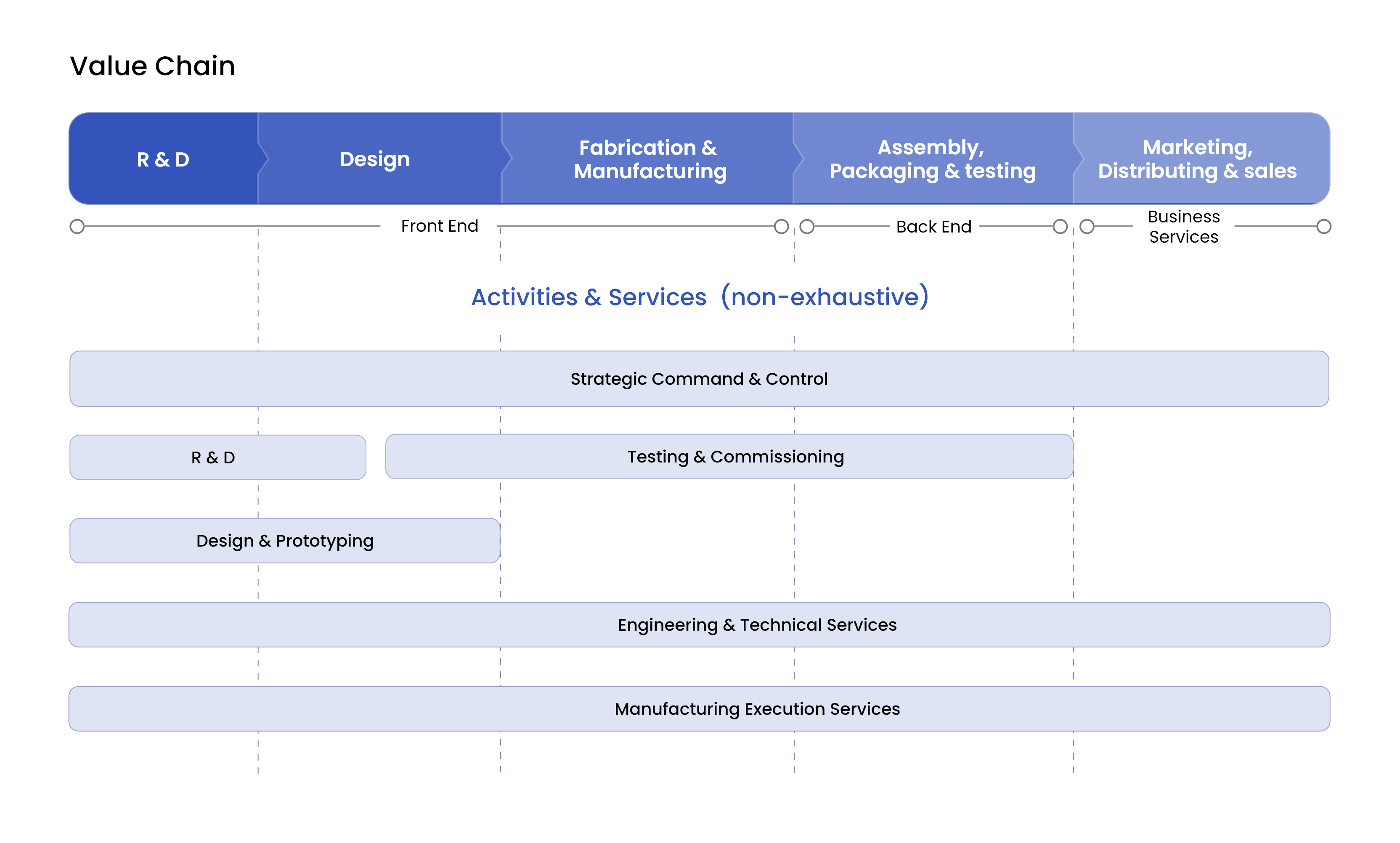

First, the sector was examined through a subsector lens, covering the various subsegments of electronics and electrical products produced within the country. Secondly, a value chain perspective was adopted to evaluate the different stages across the E&E value chain, ranging from frontend segments such as research and development & design to back-end segments such as assembly and testing, then business services including marketing, distribution and sales. Finally, the different types of activities and services engaged by the sector were analysed, looking at those which could be vertically integrated with the local E&E sector. This includes activities such as strategic command and control, where major E&E players have established their global hubs, centres of excellence, and fulfilment centres in Malaysia.

Subsectors (non-exhaustive)

- Electronic Products

- Electrical Products

Components

-

Semiconductors

Semiconductors

-

Passive components

Passive components

-

Printed Circuit Board Assembly (PCBA)

Printed Circuit Board Assembly (PCBA)

-

Leadframe

Leadframe

-

Display panel

Display panel

Consumer

-

Audio video products (television receivers,

infotainment products, etc)

Audio video products (television receivers,

infotainment products, etc)

-

Digital cameras

Digital cameras

-

Game console

Game console

Industrial

-

Telecommunications Devices

Telecommunications Devices

-

Multimedia (such as computing devices)

Multimedia (such as computing devices)

-

Digital transmission & receiver devices

Digital transmission & receiver devices

-

Data storage

Data storage

-

Energy storage

Energy storage

Electrical

-

Distribution boards Control panels

Distribution boards Control panels

-

Switching apparatus

Switching apparatus

-

Transformers, cables and wires

Transformers, cables and wires

-

Solar cells and modules

Solar cells and modules

Aspirations across each NIA for the sector

Moving forward the sector-level initiatives outlined in the New Investment Policy focuses on enabling the sector to grow moving forward, with specific target outcomes across each National Investment Aspiration.

Increase economic complexity

Malaysia’s top contributor to exports and economic complexity, with mature presence in back-end segments.

Expansion into high-value and economically complex activities by developing front-end capabilities and modernising back-end segment.

Create high-value job opportunities

Major contributor to high-skilled and semi-skilled employment, yet certain segments still rely heavily on low-cost foreign labour.

Generating opportunities for a greater share of high-skilled employment through widespread adoption of technology.

Extend domestic

linkages

Malaysia is a major exporter, but domestic participation in global value chain trails regional E&E peers.

Homegrown champions act as key suppliers across global E&E value chains, with enhanced SMEs participation.

Develop new & existing economic clusters

Mature clusters with longstanding track records built around major E&E players, but focused within several key geographies

World-class E&E clusters operating as part of comprehensive ecosystems housing global E&E leaders.

Improve

inclusivity

Investments and jobs concentrated around four select states of Penang, Johor, Selangor, and Kedah.

Economic knock-on impacts from successful local E&E sectors create wider economic benefits. Investment focusing on E&E regions creating adjacent value for the rakyat by benefiting the back-end of the E&E value chain and complementing other sectors.

Enhance ESG

practices

Environmental risks are driven by high GHG emissions and relatively short finished product life cycles.

Social risks are driven by concerns around health, safety and labour issues.

Concerted shift by industry players to minimise GHG emissions to mitigate impact from any carbon taxes in the future.

Sustained shift towards higher value-add activities within E&E value chain and wider adoption of automation to minimise social risks.

Key Investment opportunities for E & E sector

Malaysia is well positioned to leverage key short-term opportunities as they emerge over the next five years. There also remain other nascent opportunities which will require further development across key areas such as talent and innovation in order for the country to unlock the greatest potential value. These medium-term opportunities present important potential to develop the industry but will necessitate a longer timeframe to realise. While these opportunities are not ripe for Malaysia to take advantage of, they still present a medium-term opportunity as the local environment evolves. As these subsectors continue to grow in terms of market size and technology, Malaysia should take an agile and proactive approach, broadening the talent and technology understanding required to explore these opportunities.

- Short Term Opportunities (opportunities for the next 5 years)

- Medium Term Opportunities (opportunities beyond 5 years)

Initiatives to unlock E & E sector

Malaysia needs to address several pivotal challenges if it is to encourage further investments in key areas of the E&E ecosystem, particularly if it aims to capture the value highlighted in the three short-term opportunities. These efforts will need to focus on reducing barriers to evolution, promoting and developing clusters which focus on innovation and R&D as avenues of growth, and promoting the sector as an attractive investment opportunity. The New Investment Policy identifies four key initiatives to drive this transformation to ensure Malaysia remains one of the world’s finest destinations for E&E activities.

Investment accelerator targeted at participants within crucial parts of the E & E value chain (eg : R & D materials and substrate suppliers, advanced packaging players) Learn more

- Sector-wide

- Opportunity Specific

Expanded support to accelerate SME Industry 4.0 adoption

Level up MIDA’s lighthouse project through 3 key methods:

- Establish strategic partnerships between local players and MNCs/LLCs that have successfully adopted IR4.0 pillars to be the ambassadors for IR4.0 to the Malaysian vendors and partners

- Expand the quality of support of SME IR4.0 adoption, which involves key IR4.0 enablers to provide advisory services and worker upskilling programmes to enhance IR4.0 adoption and ensure appropriate workforce talent

- Offer attachment programs in lighthouse projects and demo factories to upskill and train university students and employees of firms who are trying to automate processes

Enhance E&E intra- and inter-cluster linkages

Government to drive formalised collaboration programmes through three methods:

- Design additional R&D matching programmes where companies will be matched with other companies or researchers with similar R&D pursuits

- Add features to Malaysia’s E&E supplier database to allow businesses to list their products to facilitate procurement from other businesses in the cluster

- Foster the creation of cluster consortiums to empower SMEs

Offer support to subnational IPAs for cluster development through three methods:

- Curate an updated list of talents in demand with local clusters and publicise it on job portals and universities boards

- Incentivise the setup of mentorship offices to drive intra-cluster collaboration between MNCs and SMEs

- Enhancing cluster facilities to drive innovation

Set up a joint public private E & E Sector Development Fund

Launch an E&E Sector Development Fund with the following features:

- Co funded by the government and a consortium of large private companies

- Semi-annual meetings between government and investors to discuss key priorities for the fund

- Imperative to adopt evolutionary thinking when defining priorities

Investment accelerator targeted at participants within crucial parts of the E&E value chain

Launch Investment accelerator program to augment the development of new E&E opportunities

- Identify key participants that are crucial to developing the value chains of new opportunities

- Expand on incentive packages to actively potential investors

- Work with potential leads to determine the skills and infrastructure requirements in order to attract them to invest in Malaysia

IoT sensors and components

This opportunity refers to the manufacturing of relevant equipment complementary to the growing Internet of Things (IoT) market globally. Advancing development of Malaysia’s IoT segment will also indirectly uplift the existing manufacturing base across all sectors, supporting the rollout of widespread automation and Industry 4.0 adoption, thereby enhancing the productivity of local clusters in the manufacturing of economically-complex goods in the E&E sector. Upgrading existing production facilities into smart factories through IoT can also reduce Malaysia’s reliance on low-cost foreign labour. The expected growth of smart factory technologies will also increase demand for employees skilled in data analysis and engineering, creating high-skilled job opportunities for the local workforce.

Modernise outsourced assembly and test (OSAT)

This opportunity refers to the advancement of the OSAT industry, which offers third-party integrated-circuit (IC) packaging and testing services, by for example automation. These segments tend to require greater technical expertise and produce higher value products with significant global demand, potentially extending Malaysia’s domestic linkages with the global supply chain.

Solar technologies

This opportunity refers to growing the overall solar value chain ecosystem within Malaysia, given the local sector in overall is relatively mature. Intensification of R&D activities by local players will boost requirements for higher-skilled talent such as R&D and Scientific Engineers. Furthermore, maturing the local solar value chain will also help to improve domestic access to solar products at a lower cost, encouraging further solar adoption and driving a more cost-effective energy transition. Further, existing local solar projects such as the Large-Scale Solar (LSS) programme and Net Energy Metering 3.0 scheme demonstrate the Malaysia’s commitment to accelerate the sector and provides a platform to pursue opportunities in Balance of Systems (BoS).

Automotive Electronic Components

This opportunity refers to leveraging Malaysia’s mature E&E ecosystem to support component manufacture for increasingly electrified vehicles. Although Malaysia is already home to existing production of sensors and other automotive electronic components for EV/AV, the sector’s technology level is relatively underdeveloped. The domestic EV/AV market demand also remains limited, with penetration hampered due to factors such as the lack of charging infrastructure and the appropriate regulations to encourage EV adoption. Foreign original equipment manufacturers (OEMs) are also subject to strict domestic content requirements, further preventing successful exports of such components. This complex and burdensome operating landscape inhibits the growth potential of EV/AV components in Malaysia, at least in the short term.