Aspirations across each NIA for the sector

Moving forward the sector-level initiatives outlined in the New Investment Policy focuses on enabling the sector to grow moving forward, with specific target outcomes across each National Investment Aspiration.

Increase economic complexity

Limited localised manufacture of higher value-added innovator drugs, with limited national R&D expenditure and scope to improve IP protection.

Increased value-added offerings with locally developed innovator drugs, protected by world-class IP regime.

Create high-value job opportunities

Declining rate of high-value job creation, with key gaps in skill sets needed to spur growth opportunities.

Increased rate of high-value job creation through holistic policies to coordinate across academia, industry, and foreign labour practices in developing the right skill sets.

Extend domestic linkages

Local players have limited export capabilities with Malaysia increasingly reliant on imports.

Enhanced regional competitiveness of local players with strengthened national self-sufficiency.

Develop new & existing economic clusters

Sub-scale local operations with limited localised MNC integration.

Homegrown regional champions with enhanced collaboration and integration with MNC partners.

Improve inclusivity

Strong disparities in pharmaceutical investments and subsequent job creation across states.

Increased investments into less-developed states, leveraging on enhanced botanical industry partnerships and supply chain integration.

Enhance ESG practices

Global headwinds shifting towards increased social and environmental awareness on pharmaceutical policies, with many industry leaders taking mitigative measures.

World-class standards and practices adopted across industry players to mitigate against environmental and social risks, in-line with global best practice.

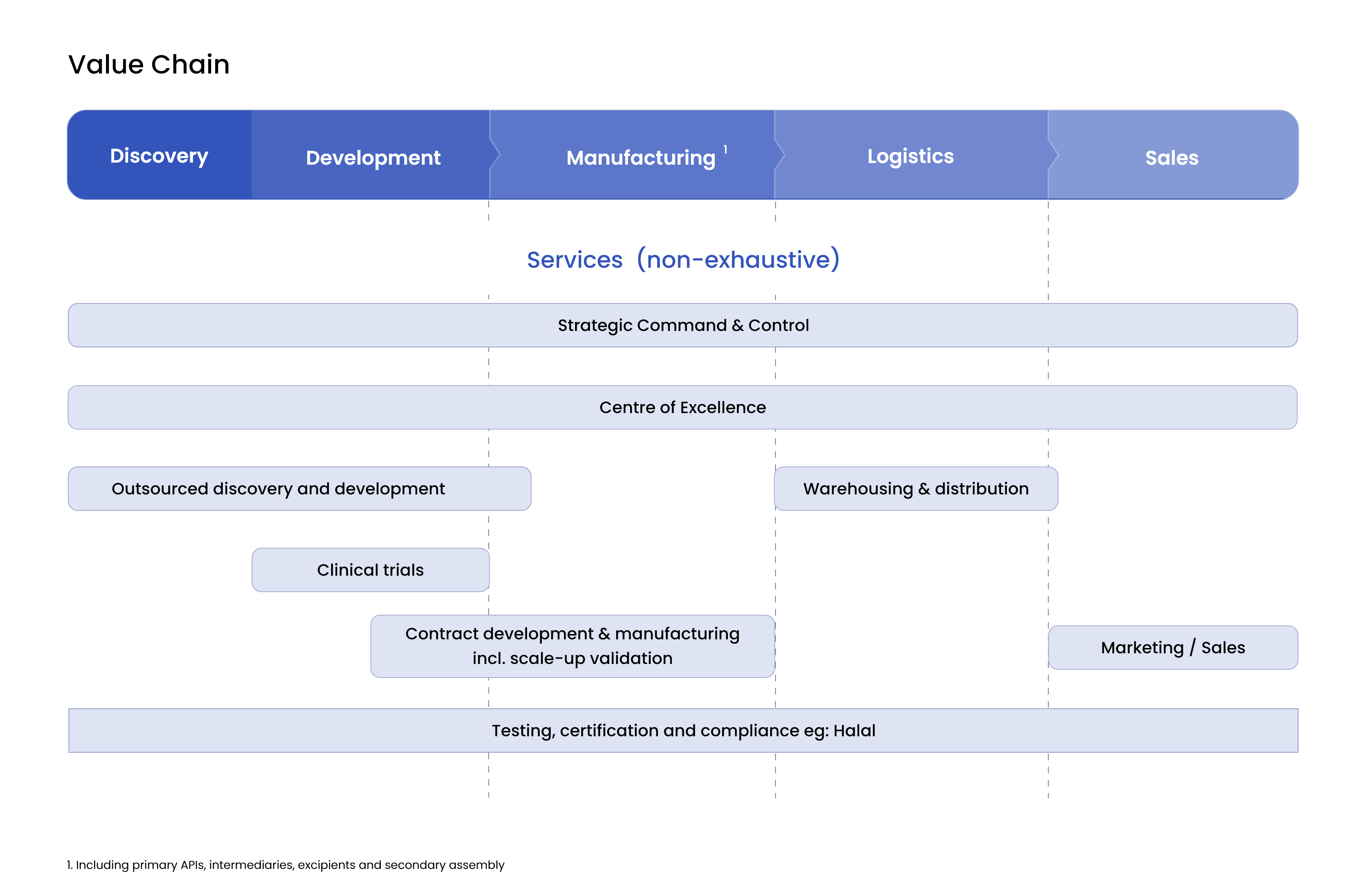

Key Investment opportunities for Pharma sector

Malaysia’s Pharmaceutical sector is positioned on a strong foundation of existing clusters, with participation across both local and multinational corporations. Furthermore, it is mature, with strong industry representation especially in generics manufacturing. Although in a nascent stage, Malaysia has also made significant strides towards exploring the biologics market, with the presence of BioCon as one of the largest insulin manufacturing facilities in Southeast Asia.

Despite major developments, Malaysia still has scope to expand its capabilities to unlock greater value in line with global healthcare trends. This includes a particularly important opportunity to capture a share of the advanced modalities market increasingly employed by global innovators. As such, it is imperative to assess Malaysia’s readiness to pursue these opportunities, whilst ensuring that the industry can deliver on national development targets. In this section, these dimensions are assessed to outline a shortlist of potential high-value investment opportunities for Malaysia.

The New Investment Policy outlines several growth opportunities

which have been segmented by its time-frame and maturity for

investments. The first set are short-term opportunities which are

ripe for investments within the next five years. The others are

medium-term opportunities, which will require Malaysia to first

strengthen its foundations before it is ready for significant

investments.

A summary is outlined below.

- Short Term Opportunities (opportunities for the next 5 years)

- Medium Term Opportunities (opportunities beyond 5 years)

Initiatives to unlock Pharma sector

Six key initiatives have been identified that are tailored to address the relevant investment impediments in order to unlock short-term opportunities within the Pharmaceutical sector. Four of these initiatives are targeted to grow specific opportunities, while two offer sector-wide potential to grow the overall industry.

Learn more

Learn more

Industry accelerator platform to increase MNC-local partnerships in targeted high-value added projects (eg : R & D materials and substrate suppliers, advanced packaging players) Learn more

- Sector-wide

- Opportunity specific