- Announcement

- Overview

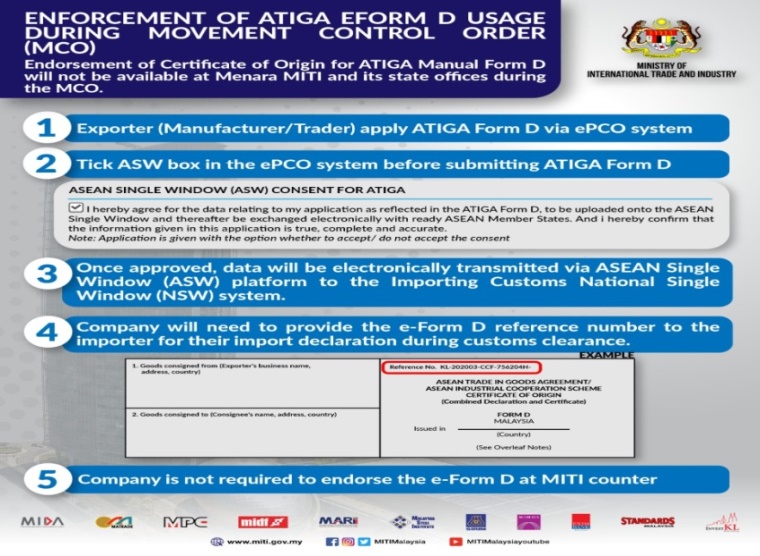

- Guidelines and Process Flow

- ATIGA e-Form D

- ASEAN Wide Self-Certification (AWSC)

- FAQ

- Links

- Contact Us

-

NOTIFICATION OF SCHEDULED ePCO SYSTEM ENHANCEMENT AND TEMPORARY SERVICE SUSPENSION

Please be informed that, ePCO system will undergo scheduled maintenance and technical enhancement from 31 October 2025 (Friday) until 2 November 2025 (Sunday). Full system functionality for all services will be fully restored on 3 November 2025 (Monday). During this scheduled period, the processing of all Cost Analysis and Certificate of Origin (CO) applications will be temporarily suspended.

Please click here for the full announcement.

-

ENTRY INTO FORCE OF THE MALAYSIA – UNITED ARAB EMIRATES COMPREHENSIVE ECONOMICS PARTNERSHIP AGREEMENT (MY-UAE CEPA) FOR MALAYSIA

MITI is pleased to announce that the Malaysia–United Arab Emirates Comprehensive Economic Partnership Agreement (MY-UAE CEPA) will officially enter into force for Malaysia on 1 October 2025.

Please click here for the full announcement.

-

CANCELLATION OF AUTO-APPROVAL FOR CERTIFICATE OF ORIGIN (CO) APPLICATIONS

Please be informed that, effective 11 August 2025, the auto-approval process for Certificate of Origin (CO) applications will be discontinued.

Please click here for the full announcement.

-

SCHEDULED MAINTENANCE OF ePCO SYSTEM

Please be informed that the ePCO system will undergo scheduled maintenance on the following date and time:

Date :28 July 2025 (Monday)

Time:12:00 a.m. – 11:59 p.m. (24 hours)

Please click here for the full announcement.

-

NOTIFICATION OF SYSTEM DOWNTIME FOR ASEAN SINGLE WINDOW (ASW) GATEWAY IN MALAYSIA

Please be informed that Malaysia is currently experiencing a technical disruption at the ASEAN Single Window (ASW) Gateway for transmitting and receiving electronic Form D (e‑Form D) has successfully resumed normal operations. As of 1 July 2025, electronic exchanges with all ASEAN Member States are back to full functionality.

Please click here for the full announcement.

-

NOTIFICATION OF SYSTEM DOWNTIME FOR APPLICATIONS OF PREFERENTIAL CERTIFICATE OF ORIGIN (PCO) UNDER ASEAN TRADE IN GOODS AGREEMENT (ATIGA) TO ASEAN DUE TO TECHNICAL ISSUE IN MALAYSIA’S ASW GATEWAY

Please be informed that Malaysia is currently experiencing a technical disruption at the ASEAN Single Window (ASW) Gateway, which began on 8 June 2025

Please click here for the full announcement.

-

ANNOUNCEMENT: MISSING FOB VALUE IN DVS FOR AIFTA AND MICECA

We are pleased to inform you that the issue regarding the missing FOB (Free on Board) value in the Digital Verification System (DVS) for the ASEAN India Free Trade Area (AIFTA) and Malaysia India Comprehensive Economic Cooperation Agreement (MICECA) has been successfully resolved by Dagang Net Technologies Sdn Bhd

Please click here for the full announcement.

-

IMPLEMENTATION OF ELECTRONICALLY AFFIXED EXPORTER SIGNATURE AND OFFICIAL SEAL VIA THE ePCO SYSTEM

The Ministry of Investment, Trade and Industry (MITI) of Malaysia introduced the revised module for the implementation of affixed exporter signature and official seal of the Preferential Certificate of Origin (PCO) since 15 January 2025 for the following Free Trade Agreement (FTA) schemes:

Please click here for the full announcement.

-

ANNOUNCEMENT

In conjunction with the 2025 Eid Al-Fitr Celebration, the ePCO and ePERMIT system will be temporary closed and open for operation as scheduled below..

Please click here for the full announcement.

-

ENTRY INTO FORCE OF THE COMPREHENSIVE AND PROGRESSIVE AGREEMENT FOR TRANS-PACIFIC PARTNERSHIP FOR THE UNITED KINGDOM

The Ministry of Investment, Trade and Industry (MITI) is pleased to inform that the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) will enter into force for the United Kingdom on 15 December 2024.

Please click here for the full announcement.

-

NOTIFICATION ON DISRUPTION: EXCHANGE OF ATIGA E-FORM D FROM MALAYSIA TO MYANMAR RESUMES BACK TO NORMAL

We kindly refer to our announcement (Notification of system downtime for applications of Preferential Certificate of Origin (PCO) under ASEAN Trade In Goods Agreement (ATIGA) to Myanmar due to technical issue in Myanmar’s ASW Gateway) published on 11 October 2024 in MITI’s portal and e-PCO System.

Please click here for the full announcement.

-

NOTIFICATION OF SYSTEM DOWNTIME FOR APPLICATIONS OF PREFERENTIAL CERTIFICATE OF ORIGIN (PCO) UNDER ASEAN TRADE IN GOODS AGREEMENT (ATIGA) TO MYANMAR DUE TO TECHNICAL ISSUE IN MYANMAR’S ASW GATEWAY

Please be informed that on 8 October 2024, MITI received a notification from the Ministry of Commerce of Myanmar on the disruption to the ASW server causing System Downtime. As a result, Myanmar’s issuing authority will only issue Hardcopy Form D until further notice...

Please click here for the full announcement.

-

ANNOUNCEMENT

In conjunction with the 2024 Eid Al-Fitr Celebration, the ePCO and ePERMIT system will be temporary closed and open for operation as ..

Please click here for the full announcement.

-

IMPLEMENTATION OF THE ASEAN-AUSTRALIA-NEW ZEALAND FREE TRADE AGREEMENT PRODUCT SPECIFIC RULES IN HS 2022 EFFECTIVE FROM 1 MARCH 2024

The Ministry of Investment, Trade and Industry (MITI) is pleased to inform that the transposition for the ASEAN-Australia-New Zealand Free Trade Agreement (AANZFTA) Product Specific Rules (PSR) from HS 2017 to HS 2022 has completed and the AANZFTA Joint Committee agreed for all AANZFTA Member Parties to implement the AANZFTA PSR in HS 2022 effective from 1 March 2024.

Please click here for the full announcement.

-

VALUE LIMITS EXPRESSED IN TURKISH LIRA FOR YEAR 2024 UNDER MALAYSIA - TURKEY FREE TRADE AGREEMENT (MTFTA)

In line with Article 4.31 of the Free Trade Agreement between the Government of Malaysia and the Government of the Republic of Türkiye (MTFTA), please be informed that the Turkish Lira equivalents of the amounts expressed in EUR and USD in order for the products to fulfil the conditions set out in Article 4.21 (Conditions for Invoice Declaration) and the Article 4.27 (Exemption from Proof of Origin) of the Agreement for the year 2024 are as follows:

Please click here for the full announcement.

-

ISSUANCE OF PREFERENTIAL CERTIFICATE OF ORIGIN (PCO) STATUS UNDER MTFTA

The Free Trade Agreement between the Government of Malaysia and the Government of the Republic of Türkiye (MTFTA) which came into force on 1 August 2015 has enabled Malaysian exporters to gain preferential market access into Türkiye.

Please click here for the full announcement.

-

IMPLEMENTATION OF THE PREFERENTIAL TRADE AGREEMENT (PTA) AMONG THE MEMBER STATES OF DEVELOPING-8 ORGANISATION FOR ECONOMIC COOPERATION (D-8) FOR MALAYSIA

Pursuant to Malaysia’s ratification of the D-8 on 20 July 2006 and the gazettement of Customs Duties (Goods under the Preferential Trade Agreement among D-8 Member States) Order 2023, the PTA of the D-8 has entered into force for Malaysia on 1 October 2023.

Please click here for the full announcement.

-

IMPLEMENTATION OF THE TRADE PREFERENTIAL SYSTEM AMONG THE MEMBER STATES OF THE ORGANISATION OF THE ISLAMIC COOPERATION (TPS-OIC) FOR MALAYSIA

Pursuant to Malaysia's ratification of the TPS-OIC agreement on 14 October 2008 and the gazettement of Customs Duties (Goods under the Framework Agreement on TPS-OIC) Order 2023, the TPS-OIC agreement has entered into force for Malaysia on 1 October 2023.

Please click here for the full announcement.

-

ENTRY INTO FORCE OF THE COMPREHENSIVE AND PROGRESSIVE AGREEMENT FOR TRANS-PACIFIC PARTNERSHIP FOR BRUNEI DARUSSALAM ON 12 JULY 2023

The Ministry of Investment, Trade and Industry (MITI) is pleased to inform that the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) will enter into force for Brunei Darussalam on 12 July 2023.

Brunei will join ten (10) other countries, namely Malaysia, Australia, Canada, Chile, Japan, Mexico, New Zealand, Peru, Singapore and Viet Nam, all of which have implemented the CPTPP.

Please click here for the full announcement. -

ENTRY INTO FORCE OF THE REGIONAL COMPREHENSIVE ECONOMIC PARTNERSHIP FOR THE PHILIPPINES ON 2 JUNE 2023

MITI is pleased to inform that the Regional Comprehensive Economic Partnership (RCEP) will enter into force for the Philippines on 2 June 2023.

The Philippines will join thirteen other signatory countries, namely Singapore, China, Japan, Brunei Darussalam, Cambodia, Lao PDR, Thailand, Viet Nam, Australia, New Zealand, South Korea, Indonesia and Malaysia that have completed the ratification process.

Please click here for the full announcement. -

ANNOUNCEMENT

In conjunction with the 2023 Eid Al-Fitr Celebration, the ePCO and ePERMIT system will be temporarily closed and open for operation as..

Please click here for the full announcement. -

DECLARATION OF AHTN 2022 IN THE ASEAN TRADE IN GOODS AGREEMENT (ATIGA) PROOF OF ORIGIN PURSUANT TO THE IMPLEMENTATION OF CUSTOMS DUTIES (GOODS OF ASEAN COUNTRIES ORIGIN) (ASEAN HARMONISED TARIFF NOMENCLATURE AND ASEAN TRADE IN GOODS AGREEMENT) (AMENDMENT) ORDER 2023

Recalling to MITI’s announcement on the Declaration of HS 2022 in the ATIGA Proof of Origin Pursuant to The Implementation of Customs Duties Order 2022 dated 2 June 2022.

Please click here for the full announcement. -

DECLARATION ON TRANSIT AND TRANSHIPMENT AND FORMAL UNDERTAKING UNDER THE COMPREHENSIVE AND PROGRESSIVE AGREEMENT FOR TRANS-PACIFIC PARTNERSHIP (FORM CPTPP)

Article 3.18 of the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) on Transit and Transhipment sets out the consignment requirements that apply to CPTPP originating goods imported into another CPTPP party.

Please click here for the full announcement. -

ENTRY INTO FORCE OF THE COMPREHENSIVE AND PROGRESSIVE AGREEMENT FOR TRANS-PACIFIC PARTNERSHIP FOR THE REPUBLIC OF CHILE ON 21 FEBRUARY 2023

The Ministry of International Trade and Industry (MITI) is pleased to inform that the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) will enter into force for The Republic of Chile on 21 February 2023.

Please click here for the full announcement. -

VALUE LIMITS EXPRESSED IN TURKISH LIRA FOR YEAR 2023 UNDER MALAYSIA-TURKEY FREE TRADE AGREEMENT (MTFTA)

In line with Article 4.31 of the Free Trade Agreement between the Government of Malaysia and the Government of the Republic of Türkiye, please be informed that the Turkish Lira equivalents of the amounts expressed in EUR and USD in order for the products to fulfil the conditions set out in Article 4.21 and the Article 4.27 of the Agreement for the year 2023 are as follows;

Please click here for the full announcement. -

ENTRY INTO FORCE OF THE REGIONAL COMPREHENSIVE ECONOMIC PARTNERSHIP FOR THE REPUBLIC OF INDONESIA ON 2 JANUARY 2023

MITI is pleased to inform that the Regional Comprehensive Economic Partnership (RCEP) will enter into force for the Republic of Indonesia on 2 January 2023.

Please click here for the full announcement. -

IMPLEMENTATION OF ELECTRONICALLY AFFIXED SIGNATURE AND OFFICIAL SEAL THROUGH THE ePCO SYSTEM FOR CPTPP, ACFTA, AIFTA, MICECA AND MTFTA

As part of our continuous improvement initiative, MITI will implement electronic endorsement of the Preferential Certificate of Origin (PCO) by electronically affixed signature and official seal through the ePCO system for CPTPP, ACFTA, AIFTA, MICECA and MTFTA. The PCO approved for the abovementioned FTAs will be electronically endorsed and exporter will no longer be required to do a manual endorsement.

Please click here for the full announcement. -

ANNOUNCEMENT : APPLICATION FOR CERTIFICATE OF ORIGIN UNDER THE COMPREHENSIVE AND PROGRESSIVE AGREEMENT FOR TRANS-PACIFIC PARTNERSHIP (FORM CPTPP)

The Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) will enter into force for Malaysia on 29 November 2022. Malaysia will become the ninth country to implement the Agreement, joining the ranks of Australia, Canada, Japan, Mexico, New Zealand, Peru, Singapore, and Viet Nam. The remaining Signatories, namely Brunei Darussalam and Chile, are still undertaking the necessary efforts to ratify the CPTPP.

Please click here for the full announcement. -

ANNOUNCEMENT : COMPREHENSIVE AND PROGRESSIVE AGREEMENT FOR TRANS-PACIFIC PARTNERSHIP EPCO WALKTHROUGH AND USER FEEDBACK SESSIONS

The Ministry of International Trade and Industry (MITI) is pleased to inform that the Government of Malaysia has submitted the Instrument of Ratification (IOR) for the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), to New Zealand, the CPTPP Depositary, on Friday, 30 September 2022. The Agreement will officially take effect for Malaysia on 29 November 2022.

Pursuant to MITI's media release on 5 October 2022, the Ministry has convened two separate sessions to educate our stakeholders on the Rules of Origin (ROO) and ePCO requirements of the CPTPP. These sessions were held on 11 and 19 October 2022, attracting participation from close to 150 companies and trade associations.

Given the demand for similar sessions, MITI will be convening two more CPTPP ePCO Walkthrough and User Feedback Sessions on 28 October 2022 and 2 November 2022.

Please click here for the full announcement. -

ANNOUNCEMENT : DECLARATION OF HS 2022 IN ALL PREFERENTIAL CERTIFICATE OF ORIGIN PURSUANT TO THE IMPLEMENTATION OF THE CUSTOMS DUTIES ORDER 2022

MITI wishes to refer to our announcement dated 2 June 2022 on the declaration of the HS 2022 for ATIGA Proof of Origin pursuant to the implementation of the Customs Duties Order 2022 by the Royal Malaysian Customs Department (RMCD).

Please click here for the full announcement. -

ANNOUNCEMENT : DECLARATION OF HS 2022 IN THE ATIGA PROOF OF ORIGIN PURSUANT TO THE IMPLEMENTATION OF CUSTOMS DUTIES ORDER 2022

MITI refers to the declaration of HS 2022 pursuant to the implementation of Customs Duties Order 2022 by the Royal Malaysian Customs Department (RMCD) on Wednesday, 1 June 2022. In this regard, MITI wishes to clarify that the implementation will only impact the incoming ATIGA Proof of Origin into Malaysia (i.e., for purposes of imports).

Please click here for the full announcement. -

ANNOUNCEMENT : SURVEY QUESTIONNAIRE ON RULES OF ORIGIN (ROO) IN THE ASEAN TRADE IN GOODS AGREEMENT (ATIGA) 2022

Please click here for the full announcement. -

ANNOUNCEMENT : IN CONJUNCTION WITH THE 2022 LABOUR DAY AND EID AL-FITR CELEBRATION, THE ePCO SYSTEM WILL BE TEMPORARY CLOSED FROM 1 MAY 2022 (SUNDAY) UNTIL 4 MAY 2022 (WEDNESDAY). THE SYSTEM WILL RESUME OPERATION ON 5 MAY 2022 (THURSDAY AT 8.00 AM).

Please click here for the full announcement. -

ANNOUNCEMENT : NOTIFICATION ON AMENDMENT TO THE OPERATIONAL CERTIFICATION PROCEDURES (OCP) UNDER THE ASEAN TRADE IN GOODS AGREEMENT (ATIGA)

Please be informed that the Thirty-Fifth (35TH) AFTA Council Meeting that was held on 8 September 2021 has endorsed the amendments to the Operational Certification Procedures (OCP) under the ASEAN Trade in Goods Agreement (ATIGA).

Please click here for the full announcement. -

ANNOUNCEMENT : NOTIFICATION ON ADDITIONAL PORTS IN THE REPUBLIC OF THE UNION OF MYANMAR THAT ARE ABLE TO ACCEPT ATIGA E-FORM D

We are pleased to inform that effective 4 April 2022, there are six (6) additional ports in the Republic of the Union of Myanmar (Myanmar), are able to exchange the ATIGA e-Form D. Thus, there will be a total of eight (8) ports in Myanmar that can accept the ATIGA e-Form D.

Please click here for the full announcement. -

ANNOUNCEMENT : MALAYSIA'S ASEAN SINGLE WINDOW (ASW) GATEWAY ISSUES HAS BEEN FIXED: EXCHANGED OF ATIGA E-FORM D WILL RESUME BACK TO NORMAL

We kindly refer to our announcement published on 16 March 2022 in MITI's portal and e-PCO system.

Please be informed that the technical issues have been successfully rectified and Malaysian traders may now resume the exchange of the ATIGA e-Form D to ASEAN Member States (AMS) as usual.

Please click here for the full announcement. -

ANNOUNCEMENT : NOTIFICATION ON ISSUANCE OF PAPER-BASED FORM D WITH ELECTRONICALLY AFFIXED SIGNATURE AND SEAL FOR APPLICATIONS OF PREFERENTIAL CERTIFICATE OF ORIGIN (PCO) UNDER THE ASEAN TRADE IN GOODS AGREEMENT (ATIGA) DUE TO TECHNICAL ISSUE IN MALAYSIA'S GATEWAY

This is to inform that Malaysia's Production Gateway is unable to send or receive ATIGA e-Form D and its related responses due to technical problem. The ePCO System however is not impacted by this and is able to run its normal operations (ie. applying, approving and verifying of Cost Analysis (CA) and Certificate of Origin (CO).

Please click here for the full announcement. -

ANNOUNCEMENT : IMPLEMENTATION OF THE REGIONAL COMPREHENSIVE ECONOMIC PARTNERSHIP (RCEP) AGREEMENT FOR MALAYSIA

We are pleased to update and share key information of RCEP implementation and issuance of Form RCEP.

Please click here for the full announcement. -

ANNOUNCEMENT : IMPLEMENTATION OF THE REGIONAL COMPREHENSIVE ECONOMIC PARTNERSHIP (RCEP) FOR MALAYSIA

Pursuant to Malaysia's ratification of the Regional Comprehensive Economic Partnership (RCEP) agreement on 17 January 2022, the RCEP agreement will enter into force for Malaysia on 18 March 2022 (60 days after its submission of Instrument Of Ratification (IOR) as per article 20.6 of RCEP Agreement).

Malaysia shall join the eleven other parties namely Singapore, China, Japan, Brunei Darussalam, Cambodia, Lao PDR, Thailand, Viet Nam, Australia, New Zealand and Korea that have completed the ratification process and implemented the agreement. The remaining signatories (Indonesia, Myanmar and Philippines) are yet to complete its ratification process.

Please click here for the full announcement. -

ANNOUNCEMENT : DECLARATION OF HS2022 IN THE PREFERENTIAL CERTIFICATE OF ORIGIN (PCO)

The Ministry of International Trade and Industry (MITI) has received inquiries from Malaysian exporters pertaining to the request by several Members States to indicate Harmonized System (HS) nomenclature 2022 in the PCO, as well as challenges faced by their importers to claim for preferential treatment when using the HS2017 in the PCO forms, due to the implementation of HS2022 for import/export declaration in their country effective from 1 January 2022.

MITI noted that the implementation of HS2022 has attributed to changes in the importing country HS Code for a wide range of goods including difference in subheadings specifically at the fifth and sixth digit level. Please be informed that the transposition exercise in several Free Trade Agreements (FTAs) are yet to be completed. MITI is of the view that until it is finalized, the HS2017 should be used in the PCO forms.

Please click here for the full announcement. -

ANNOUNCEMENT : MYANMAR'S GATEWAY ISSUES HAS BEEN FIXED: EXCHANGED OF ATIGA E-FORM D TO PORT OF THILAWA AND YANGON, MYANMAR WILL RESUME BACK TO NORMAL

We kindly refer to our announcement (Announcement Myanmar's Gateway Error) published on 24 November 2021 in MITI's portal and e-PCO system.

Please be informed that we have received updates from Myanmar's officials that they have successfully rectified the technical issues, and ASEAN Member States (AMS) may now resume the exchange of the ATIGA e-Form D to/or from Myanmar (for port of Yangon and Thilawa).

In this regard, starting from 1 December 2021, all applications of PCO under the ATIGA scheme to Myanmar will resume back to normal where the ASW consent box will be automatically ticked and locked to port Yangon (MMRGN) and Thilawa (MMTLA) to enable the exchange of the ATIGA e-Form D. Exportation to other ports will remain via paper-based ATIGA Form D with electronically affixed signature and seal, until the remaining ports in Myanmar are able to accept ATIGA e-Form D.

Please click here for the full announcement. -

ANNOUNCEMENT : ISSUANCE OF PAPER-BASED FORM D WITH ELECTRONICALLY AFFIXED SIGNATURE AND SEAL FOR APPLICATIONS OF PREFERENTIAL CERTIFICATE OF ORIGIN (PCO) UNDER ASEAN TRADE IN GOODS AGREEMENT (ATIGA) TO MYANMAR DUE TO TECHNICAL ISSUE IN MYANMAR’S GATEWAY

Please be informed that on 19 November 2021, MITI received notification from the ASEAN Secretariat (ASEC) informing that currently Myanmar is facing technical difficulties in implementing technical and security upgrades in ASEAN Single Window (ASW) Gateway, which caused Myanmar could not exchange ATIGA e-Form D to/or from ASEAN Member State (AMS). As a result, ATIGA Form D transmitted electronically to Myanmar could not be exchanged and will remain at exporting country’s gateway.

Therefore, as agreed in the 51st Meeting of Working Group on Technical Matters for the ASW, the paper-based Form D may be used during system downtime or when there are technical issues which could not be resolved promptly or in the ports/points of entry which are still not capable of receiving the ATIGA e-Form D. In this regard, until Myanmar resolves her technical issues, Malaysia will allow paper-based Form D issuance to all ports in Myanmar.

Please click here for the full announcement. -

NOTIFICATION ON TEMPORARY CLOSURE OF MITI MALACCA SERVICE COUNTER ON 24 NOVEMBER 2021

In view of the announcement made by the Management of Perbadanan Kemajuan Negeri Melaka (PKNM) on temporary closure of the offices in Bangunan Menara MITC including PKNM's main offices from 23 November 2021 until 24 November 2021 (Wednesday) for disinfection works, please be informed that MITI Malacca Service Counter will be closed on the following dates: 24 November 2021 (Wednesday).

In this regard, collection and submission of Certificate of Origin (COO) in PKNM Gallery shall resume on 25 November 2021 (Thursday) in accordance with MITI Malacca Service Counter operating procedure during The National Recovery Plan.

Please click here for the full announcement. -

SERVICE COUNTER OPERATION HOURS OF MITI TOWER, JALAN SULTAN HAJI AHMAD SHAH, KUALA LUMPUR AND MITI BRANCHES DURING THE NATIONAL RECOVERY PLAN

In line with the transition of the National Recovery Plan (PPN) to Phase 4 for the Lembah Klang effective from 18 October 2021, counter service in MITI Tower, Jalan Sultan Haji Ahmad Shah, Kuala Lumpur will operate as usual without an appointment. The operation hours for counter service in MITI Tower and MITI Branches are as follows:MITI Office

Operation Hours

MITI Tower, Jalan Sultan Haji Ahmad Shah, Kuala Lumpur

Monday-Thursday

8.30 am 1.00 pm & 2.00 pm 5.00 pm

Friday

8.30 am 12.15 pm & 2.45 pm 5.00 pmPerak, Pahang, Penang, Johor, Kelantan, Sabah, Sarawak and counter service MITI Malacca

Please refer to the operation hours applied by each MITI Branches.

Please click here for the full announcement. -

NOTIFICATION : SCHEDULE DOWNTIME FOR MALAYSIA ASEAN SINGLE WINDOW (ASW) GATEWAY

This is to inform that there will be system maintenance activity taking place in Malaysia’s ASW environment which will result to Malaysia’s ASW Gateway being temporarily down during the following date and time:

Date

Time (Malaysia Time)

24 September, 2021 (Friday)

10.00 am – 6.00 pm

During this period, Malaysia will not be able to send and receive e-Form Ds / ACDD and its related responses. ePCO System normal operation will be not be impacted (ie. applying, approving, verifying at ePCO will be functioning as usual). For e-Form D, no ASW Activities will be displayed in the ePCO system.e-Form D will be sent to the importing countries after the ASW Malaysia Gateway maintenance activities are completed.Should you require more information & technical assistance, please reach out to our Careline at 1 300 133 133 or email careline@dagangnet.com.

-

NOTIFICATION ON THE FINAL ISSUANCE OF FORM A GENERALIZED SYSTEM OF PREFERENCES (GSP) FOR EXPORTATION TO RUSSIA, BELARUS AND KAZAKHSTAN

Effective on 12 October 2021 Ministry of International Trade and Industry (MITI) will no longer issue Form A GSP for exportation to Russia, Belarus and Kazakhstan. This is in line with the decision of the Eurasian Economic Commission (EEC) to remove Malaysia from the category of users of the unified system of the tariff preferences Eurasian Economic Union (EAEU) due to Malaysia's upper middle-income status.

Please click here for the full announcement. -

NOTIFICATION ON TEMPORARY CLOSURE OF MITI MALACCA SERVICE COUNTER FROM 14 JULY 2021 UNTIL 16 JULY 2021

In view of the announcement made by the Management of Perbadanan Kemajuan Negeri Melaka (PKNM) on temporary closure of the offices in Bangunan Menara MITC including PKNM’s main offices from 14 July 2021 (Wednesday) until 16 July 2021 (Friday) for disinfection works, please be informed that MITI Malacca Service Counter will be closed on...

Please click here for the full announcement. -

ANNOUNCEMENT : SERVICE COUNTER OPERATION HOURS OF MITI HQ AND MITI BRANCHES DURING THE MOVEMENT CONTROL ORDER (TOTAL LOCKDOWN) 3.0

Following the announcement of the Movement Control Order (Total Lockdown) effective 1 June 2021 until 14 June 2021, operation hours for counter service of MITI HQ and MITI Branches are...

Please click here for the full announcement. -

NOTIFICATION ON EXTENSION OF TEMPORARY CLOSURE OF MITI MALACCA SERVICE COUNTER FROM 31 MAY 2021 UNTIL 2 JUNE 2021

Following the announcement made by the Management of Perbadanan Kemajuan Negeri Melaka (PKNM) on extension of temporary closure of the offices in Bangunan Menara MITC including PKNM’s main offices from 31 May 2021 until 2 June 2021 for...

Please click here for the full announcement. -

NOTIFICATION ON TEMPORARY CLOSURE OF MITI MALACCA SERVICE COUNTER FROM 27 MAY 2021 UNTIL 28 MAY 2021

In view of the announcement made by the Management of Perbadanan Kemajuan Negeri Melaka (PKNM) on temporary closure of the offices in Bangunan Menara MITC including PKNM’s main offices from 26 May 2021 until 28 May 2021 for...

Please click here for the full announcement. -

E-FORM D TRANSACTION CANNOT BE FOUND IN VIETNAM CUSTOMS SYSTEM

Please be informed that MITI has recently received complaints from traders that their e-Form D cannot be found in Viet Nam Customs System...

Please click here for the full announcement. -

NOTIFICATION ON CHANGES TO THE EPCO SYSTEM TO SUPPORT FULL UTILISATION OF ASEAN TRADE IN GOODS AGREEMENT (ATIGA) ELECTRONIC FORM D (e-FORM D)

MITI no longer issue paper-based Form D since 18 March 2020 and all ATIGA Form Ds are transmitted electronically via the ASEAN Single Window (ASW) for Normal, Back-to-Back and Third Country Invoicing except for certain...

Please click here for the full announcement. -

NOTIFICATION ON CHANGES TO THE EPCO SYSTEM TO SUPPORT IMPLEMENTATION OF UPDATED CERTIFICATE OF ORIGIN ATIGA FORM D

The First Protocol to Amend the ATIGA which includes amendment of Annex 7 - Certificate of Origin (CO) Form D ATIGA and its Overleaf Notes and Annex 8 - Operational Certification Procedure (OCP) has entered into force on...

Please click here for the full announcement. -

NOTIFICATION ON REVISED PROCEDURE FOR BACK-TO-BACK PREFERENTIAL CERTIFICATE OF ORIGIN (PCO) APPLICATION

Please be informed that effective 21 October 2020, exporters applying for a Back-to-Back Preferential Certificate of Origin (PCO) application case shall key in the following information in a dedicated column/box in the ePCO application system as indicated in...

Please click here for the full announcement. -

IMPLEMENTATION OF THE THIRD-PARTY INVOICING UNDER MALAYSIA-NEW ZEALAND FREE TRADE AGREEMENT (MNZFTA) SCHEME

We are pleased to inform that effective from 1 October 2020, exporters will be allowed to utilise the arrangement of Third-Party Invoicing (TPI) under Malaysia-New Zealand Free Trade Agreement (MNZFTA). The inclusion of TPI is in accordance with Cabinet's approval on the amendment of Article 1 of Annex 3 Procedures and Verification under MNZFTA. For information, the revised...

Please click here for the full announcement. -

IMPLEMENTATION OF ASEAN WIDE SELF CERTIFICATION SCHEME AND CESSATION OF SELF-CERTIFICATION PILOT PROJECT 1

The First Protocol to amend the ASEAN Trade in Goods Agreement (ATIGA) to allow ASEAN-Wide Self-Certification (AWSC) has entered into force on 20 September 2020. The AWSC is a trade facilitation initiative that allows exporters who have demonstrated their competence to comply with ATIGA rules of origin requirements, known as "certified exporters", to self-certify the origin status for...

Please click here for the full announcement. -

IMPLEMENTATION OF ELECTRONICALLY AFFIXED SIGNATURE AND SEAL ON ATIGA FORM D FOR EXPORTATION TO THE REPUBLIC OF THE UNION OF MYANMAR

The Republic of the Union of Myanmar (Myanmar) at the 33rd ASEAN Subcommittee on Rules of Origin (SCAROO) Meeting held on 22 to 23 June 2020 had informed that she could now accept paper-based ATIGA Form D with electronically affixed signature and seal at ports that are not listed in the list of ports that are ready to accept e-Form D (Appendix A11 and A12).

Please click here for the full announcement. -

[UPDATES] IMPLEMENTATION OF REGISTERED EXPORTER (REX) SYSTEM UNDER GENERALIZED SYSTEM OF PREFERENCES (GSP) NORWAY AND SWITZERLAND (INCLUSIVE LIECHTENSTEIN)

Pursuant to the implementation of Registered Exporter (REX) System under Generalized System of Preferences (GSP) Norway and Switzerland (inclusive Liechtenstein) which will commence effective on 1 July 2020, we wish to update on important dates related to application of GSP Form A via ePCO System.-

MITI will no longer issue GSP Form A for exportation to Norway and Switzerland (inclusive Liechtenstein) starting 15 June 2020 (Monday).

-

Final date submission of Form A : 11 June 2020 (Thursday).

-

Final date resubmission of Form A (after queried) : 14 June 2020 (Sunday).

-

Final approval of Form A : 14 June 2020 (Sunday).

-

Submission/Resubmission of application Form A after abovementioned dates will be rejected.

-

Starting 1 July 2020, Norway and Switzerland (inclusive Liechtenstein) authorities will only accept declaration of Statement on Origin (SOO) for GSP and no longer accept hardcopy Form A.

-

Each company is required to present self-declaration SOO based on the Origin Criteria from GSP Cost Analysis (CA) approved by MITI via ePCO System.

- *Full notification on REX implementation, kindly refer to this link. | **REX Registration, kindly refer to this link.

-

-

Annoucement: In conjunction with the Eid Al-Fitr celebration the ePCO,ePermit and TFIS will be closed from 24 May 2020 (Sunday) until 26 May 2020 (Tuesday). The system will be resume operation on 27 May 2020 (Wednesday at 8.00 AM).

Please click here for the full announcement. -

MEDIA RELEASE : LATEST PROCEDURES FOR ENDORSEMENT OF PREFERENTIAL CERTIFICATE OF ORIGIN FOR COMPANIES DURING THE CONDITIONAL MOVEMENT CONTROL ORDER (CMCO) PERIOD

Please click here for the full media release. -

HOW COMPANY CAN CHECK THE STATUS OF ATIGA E-FORM D TRANSACTIONS IN THE ELECTRONIC PREFERENTIAL CERTIFICATE (EPCO) SYSTEM

Please click here for the full notification. -

NOTIFICATION ON IMPLEMENTATION OF REGISTERED EXPORTER (REX) SYSTEM UNDER GENERALIZED SYSTEM OF PREFERENCES (GSP) NORWAY AND SWITZERLAND

We are pleased to inform that the implementation of Registered Exporter (REX) system under Generalized System of Preferences (GSP) Norway And Switzerland will commence effective on 1 July 2020. In line with this development, exporters are required to present a self-declaration Statement on Origin (SOO) made out on invoice or commercial documents as a proof of origin for exportation of goods from Malaysia to Norway and Switzerland. MITI will no longer issue the Certificate of Origin Form A for above-mentioned countries effectively from 15 June 2020. Submission deadline for application as Registered Exporter is 15 May 2020.

Full notification on REX implementation, kindly refer to this link. -

IMPLEMENTATION OF ELECTRONIC SIGNATURE AND SEAL THROUGH THE EPCO SYSTEM

As part of our continuous service improvement initiative, MITI will implement electronic endorsement of the Preferential Certificate of Origin (PCO) by affixing electronic signature and official seal through the ePCO system. With this, PCO approved starting 13 April 2020 will be electronically endorsed and exporters will no longer need to be physically present at the MITI Service Counter for manual endorsement.

Please click here for the full notification. -

MEDIA RELEASE : MITI INTRODUCES ALTERNATIVE WAY TO FACILITATE THE ENDORSEMENT OF CERTIFICATE OF ORIGIN FOR COMPANIES DURING THE MOVEMENT CONTROL ORFER (MCO)

Please click here for the full media release. -

TEMPORARY CLOSURE OF MITI COUNTER SERVICES IN MENARA MITI AND ITS STATE OFFICES DURING THE MOVEMENT CONTROL ORDER PERIOD EFFECTIVE ON 30 MARCH 2020

Based on the increasing number of COVID19 cases despite the Movement Control imposition, the service counter in Menara MITI and its state offices will be temporarily closed to public effective on 30 March 2020.

However, processing of Cost Analysis (CA) and Certificate of Origin (COO) will be done remotely through the ePCO system. The Certificate of Origin is valid up to 12 months from the date of issuance. As such, for schemes other than ATIGA, the endorsement can be done after the Movement Control Order has been rescinded.

Please click here for the full notification. -

UTILISATION OF ASEAN TRADE IN GOODS AGREEMENT (ATIGA) E-FORM D DURING THE MOVEMENT CONTROL ORDER PERIOD FROM 18 TO 31 MARCH 2020

The government has imposed a Movement Control Order from 18 to 31 March 2020.

In order to continue facilitating the industry during this period, MITI will start enforcing the utilisation of ATIGA e-Form D for Normal, Back-to-Back and Third Country Invoicing application effective immediately. This means, no manual endorsement of Certificate of Origin will be done for ATIGA Form D. Companies are required to...Please click here for the full notification.

-

NOTIFICATION ON IMPLEMENTATION OF REVISED CHECKLIST FOR BACK-TO-BACK PREFERENTIAL CERTIFICATE OF ORIGIN APPLICATION

Please be informed that effective 2 February 2020, the requirement for Malaysian exporter to submit the invoice, packing list, bill of lading and K8 export declaration from the first exporting party are removed. This revision is to facilitate the back-to-back PCO application.

Information on the revised checklist for back-to-back PCO application can be viewed through the following link. For further inquiry regarding this matter you may email to webmiti@miti.gov.my.

-

INVITATION TO EXPORTERS TO PARTICIPATE IN THE ASEAN SINGLE WINDOW (ASW) TRADER SURVEY

The ASEAN Single Window (ASW) is a regional initiative that connects and integrates National Single Windows (NSWs) of the 10 ASEAN Member States (AMS). ASW provides a secure IT architecture and legal framework that allows trade, transport, and commercial data to be exchanged electronically among government agencies and/or the trading community.

Please click here for the full notification.

-

(IMPORTANT UPDATES): NOTIFICATION ON IMPLEMENTATION OF PRODUCT SPECIFIC RULES (PSR) IN HARMONISED CODE 2017 (HS 2017)FOR ASEAN-AUSTRALIA-NEW ZEALAND FREE TRADE AGREEMENT (AANZFTA)

We are pleased to inform that beginning from 1 October 2019, Product Specific Rules (PSR) in harmonised Code 2017 (HS 2017) has been implemented under Asean-Australia-New Zealand Free Trade Agreement (AANZFTA).

This is in accordance with the federal government gazette on the customs duties (goods under the agreement establishing the Asean-Australia-New Zealand Free Trade Area) order 2019.

Pursuant to this, all Cost Analysis (CA) applications submitted from 1 October 2019 are evaluated based on the newly gazetted PSR.

For more information on AANZFTA in HS 2017, kindly refer to this link.

Please click here for the full notification.

-

NOTIFICATION ON IMPLEMENTATION OF PRODUCT SPECIFIC RULES (PSR) IN HS 2017 FOR ASEAN-KOREA FREE TRADE AREA (AKFTA)

We are pleased to inform that the implementation of Product Specific Rules (PSR) in HS 2017 for ASEAN-Korea Free Trade Area (AKFTA) has taken into effect beginning 1 January 2020.

In line with this development; please be informed that all Cost Analysis (CA) application submitted from 1 January 2020 onwards will be evaluated under PSR in HS 2017.

For information on PSR AKFTA in HS 2017, kindly refer to this link.

-

ANNOUNCEMENT : NOTIFICATION ON THE LIVE OPERATION OF ASEAN SINGLE WINDOW (ASW) BY THE LAO PEOPLE'S DEMOCRATIC REPUBLIC AND REPUBLIC OF THE PHILIPPINES

We are pleased to inform that starting 23 December 2019, the Lao People's Democratic Republic (Laos) and the Republic Of The Philippines (Philippines) are ready to join the other 8 participating member states (Malaysia, Brunei, Cambodia, Indonesia, Myanmar, Singapore, Thailand and Vietnam) in exchanging the electronic Preferential Certificate Of Origin (e-ATIGA Form D) via the Asean Single Window (ASW) platform.

Please click here for the full notification.

-

ANNOUNCEMENT : NOTIFICATION ON THE LIVE OPERATION OF ASEAN SINGLE WINDOW (ASW) BY THE REPUBLIC OF THE UNION OF MYANMAR

We are pleased to inform that starting 9 december 2019, the Republic of the Union of Myanmar is ready to join the other 7 participating member states (Malaysia, Brunei, Cambodia, Indonesia Singapore, Thailand and Vietnam) in exchanging the electronic preferential certificate of origin (e-ATIGA form D) via the Asean single window platform.

Please click here for the full notification.

-

(IMPORTANT UPDATES) : NOTIFICATION ON POSTPONEMENT OF ASEAN-HONG KONG, CHINA FREE TRADE AGREEMENT (AHKFTA) IMPLEMENTATION

Kindly be informed that the implementation of Asean-Hong Kong, China Free Trade Agreement (AHKFTA) for Malaysia is postponed to 13 october 2019.

Please click here for the full notification.

-

(LATEST UPDATES) : NOTIFICATION ON IMPLEMENTATION OF UPGRADING PROTOCOL OF ASEAN-CHINA FREE TRADE AREA (ACFTA)

With reference to the previous notification on the Implementation of the revised Rules of Origin Chapter under the ACFTA Upgrading Protocol from Ministry Of International Trade And Industry (MITI). We are pleased to inform that the implementation of the revised Rules of Origin (ROO), Operational Certification Procedures (OCP), Preferential Certificate of Origin (PCO Form E) and Product Specific Rules (PSR) in HS2017 under the ASEAN-CHINA Free Trade Area (ACFTA) will take effect beginning 15 August 2019.

Please click here for the full notification.

-

(IMPORTANT UPDATES) NOTIFICATION ON IMPLEMENTATION OF UPGRADING PROTOCOL OF ASEAN-CHINA FREE TRADE AREA (ACFTA)

Kindly be informed that due to new circumstances regarding the implementation of ACFTA Upgrading Protocol, all current approved Cost Analysis (CA) shall maintain its original validity date and exporters may use the current CA to apply for Certificate of Origin (CO) as usual until further notice. All approved CO during this period must be printed on the old Form E (FMM pre-printed Form E).

Please click here for the full notification.

-

NOTIFICATION ON IMPLEMENTATION OF UPGRADING PROTOCOL OF ASEAN-CHINA FREE TRADE AREA (ACFTA)

We are pleased to inform that in pursuant of the Upgrading Protocol of ACFTA, the Leaders from the ten ASEAN Member States of Brunei, Cambodia, Indonesia, Lao PDR, Malaysia, Myanmar, The Philippines, Singapore, Thailand and Viet Nam, along with The People’s Republic of China have agreed to implement the Revised ACFTA Rules of Origin (ROO) Text, Revised Operational Certification Procedures (OCP), Product Specific Rules (PSR) in HS 2017 and Revised Preferential Certificate of Origin (PCO Form E) starting 1 August 2019, however this date is subject to readiness of other Member States. Exporters will be notified further shall there be any changes to this date.

Please click here for MITI notification on Implementation of Upgrading Protocol of ASEAN – China Free Trade Area.

Please click here for Overview and Updates on ACFTA Rules of Origin (ROO), Product Specific Rules (PSR) and Operational Certification Procedures (OCP).

-

Preferential Certificate of Origin (PCO)

-

Preferential Certificate of Origin (PCO) is a document to prove the origin status of a product. It also acts as an import document to the customs of importing country in order for a product to enjoy tariff concession.

-

Preferential Certificate of Origin (PCO) is an important international trade document attesting that goods in a particular export shipment are wholly obtained, produced entirely, manufactured or processed in a particular country.

-

A Preferential Certificate of Origin (PCO) allows your buyer to pay lower customs duty or total removal of customs duty when you export your goods under a Free Trade Agreement (FTA) or Scheme of Preferences

-

-

Concluded Free Trade Agreement (FTA) in Malaysia

-

There are 15 concluded and implemented FTAs between Malaysia and other countries as listed below. Company may export using any of the FTAs below relevant to suit their business arrangement.

-

Guidelines to apply for Preferential Certificate of Origin (PCO)

Manufacturers / Exporters need to determine the origin of their products to enjoy tax reduction or elimination by presenting the Preferential Certificate of Origin (PCO) to the Importing Country. In Malaysia, all application must be made online through the Electronic Preferential Certificate of Origin (ePCO) System operated by DagangNet Technologies Sdn Bhd (DNT).

The ePCO system is a web-based application and approval system. All attachments need to be uploaded online with no hardcopy documents to be sent to MITI. The system can be accessed at www.newepco.dagangnet.com.my.

Other functions for the system include online enquiry of application status and to provide support and guidance for users. There are two modules available in the ePCO system, one of it is the Standard Module provided for the traders and manufacturers as to apply online Cost Analysis (CA) and Preferential Certificate of Origin (PCO). The other module is the Manufacturer Module specific for manufacturers who would like to assign their CA to other Traders (to be used for PCO Form application) without exposing their finished products' actual costs (which can be obtained from CA application).

Pocket Talks on PCO are held regularly by MITI for exporters who wish to gain more information.

Click HERE to Register.

Click HERE to view Pocket Talk Slide on Introduction to PCO.

STEP 1 - Register your company with Dagangnet

-

Register online at www.dagangnet.com

-

ePCO Registration Procedures With MITI (Application checklist Manufacturer & Trader)

-

Once approved, companies will be provided with User ID and Password.

-

Study the online tutorial provided or attends classes conducted by the Service Provider.

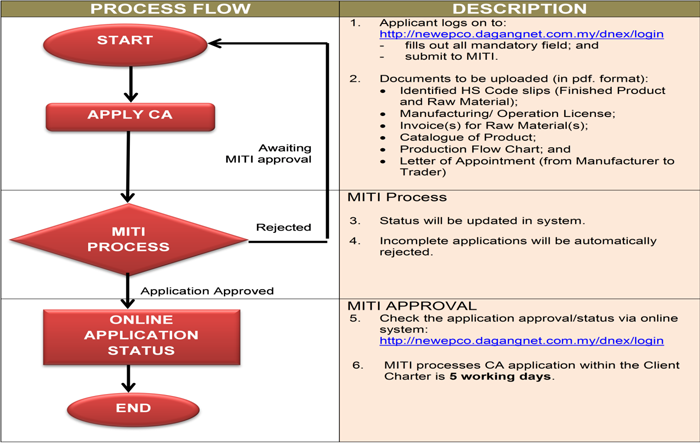

STEP 2 - Application for Cost of Analysis (CA)

-

Establish tariff classification or Harmonized System (HS) code of product.

(Note: HS code for every product or raw materials used can be referred to Division of Classification, Royal Customs of Malaysia) -

Check if the product is included in the tariff reduction and elimination schedule.

-

Fill in all information required and upload relevant documents through the Electronic Preferential Certificate of Origin (ePCO) system.

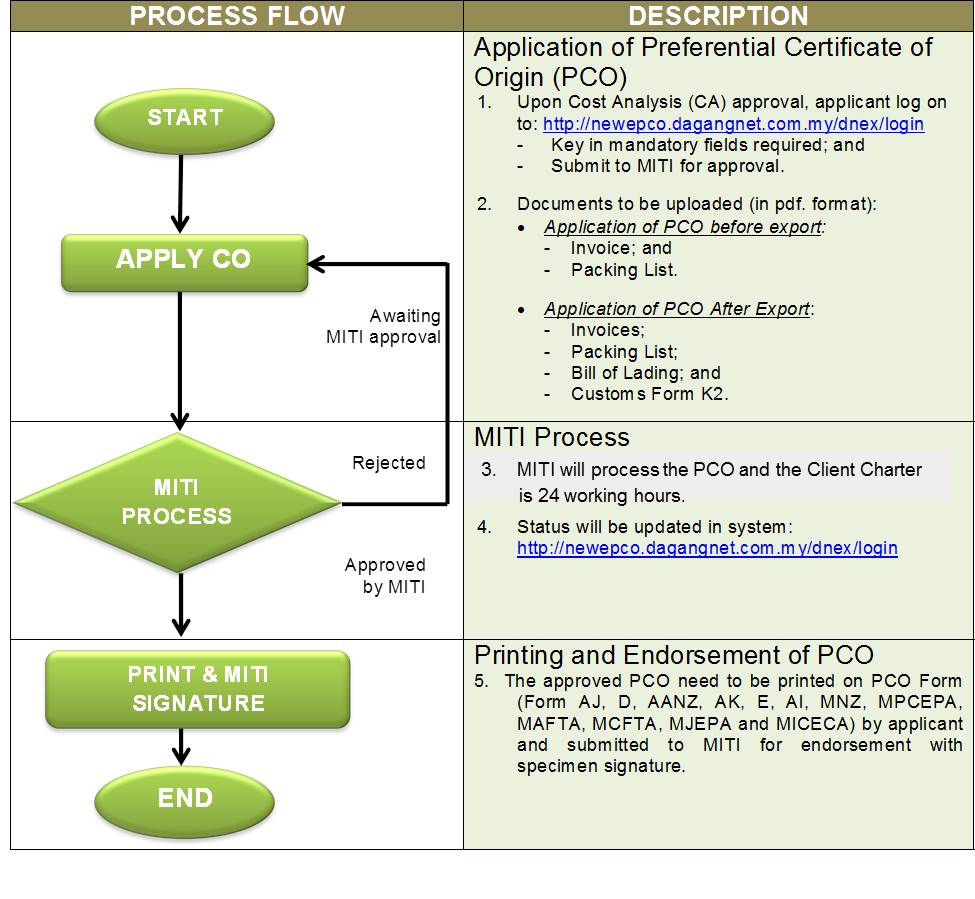

STEP 3 - Application for Preferential Certificate of Origin (PCO)

Fill in all information required and upload relevant documents through the Electronic Preferential Certificate of Origin (ePCO) system based on approved Cost of Analysis (CA).

STEP 4 - Endorsement of PCO

-

Print out approved PCO on pre-printed Certificate of Origin (CO) forms in accordance with respective schemes.

-

Required documents for endorsement:

-

Printed Certificate of Origin

-

Original copy of Invoices

-

Original Packing List

-

Original Bill of Lading

-

Original Customs Form K2

-

-

The certifying authority for all the Preferential Certificates of Origin is the Trade and Industry Cooperation Section of MITI.

-

The approval and CO endorsement services are also available at MITI offices below:

|

OFFICE |

TIME |

|

|

KUALA LUMPUR |

Level 2, Menara MITI, Jalan Sultan Haji Ahmad Shah, 50480 Kuala Lumpur |

Monday – Thursday |

|

MALACCA |

Pejabat SME Corp Negeri Melaka |

Monday – Friday |

|

PERAK |

Pejabat MITI Wilayah Perak |

Monday – Friday |

|

PENANG |

Pejabat MITI Wilayah Utara |

Monday – Friday |

|

JOHORE |

Pejabat MITI Wilayah Johor |

Monday – Thursday |

|

KELANTAN |

Pejabat MITI Wilayah Kelantan |

Sunday – Wednesday |

|

PAHANG |

Pejabat MITI Wilayah Pahang |

Monday – Friday |

|

SABAH |

Pejabat MITI Wilayah Sabah |

Monday – Friday |

|

SARAWAK |

Pejabat MITI Wilayah Sarawak |

Monday – Friday |

What is ATIGA e-Form D?

ATIGA Electronic Certificate of Origin (e-Form D) is a paper-less Certificate of Origin (CO).

Traders are not required to print the approved CO as it will be transmitted electronically to the Importing Member States via the ASEAN Single Window (ASW) upon approval by MITI as the Issuing Authority.

To allow the ATIGA e-Form D to be successfully exchanged, the data transmitted must follow a specific Business Process Specification and Message Implementation Guideline (MIG).

What is ASEAN Single Window?

The ASEAN Single Window (ASW) is a regional initiative that connects and integrates National Single Windows (NSWs) of ASEAN Member States.

What is Message Implementation Guideline (MIG)?

Message Implementation Guideline covers the structure of the ATIGA e-Form D and related documents for cross border exchange.

This guideline provides instructions for implementing message type using a standard message to associated XML messages requests and replies needed to communicate with ASW services.

Data elements in the ATIGA e-Form D (UOM, Kind of Package, Port of Discharge)

Exporters need to ensure that the data elements selected are listed in the appendices of MIG. If the data is not listed in the MIG it will caused the transaction error and the importer unable to proceed with Customs Clearance. The said attachments as follows:

Updated

Updated

-

Unit of Measurement - Appendix A.9 Updated MIG Version 3.1.6

-

Unit of Measurement (Specified Quantity) - Appendix A.10 Updated MIG Version 3.1.6

-

Kind of Package - Appendix A.11 Updated MIG Version 3.1.6

-

Port of Discharge - Appendix A.12 Updated MIG Version 3.1.6 or Appendix A.13 Updated MIG Version 3.1.6

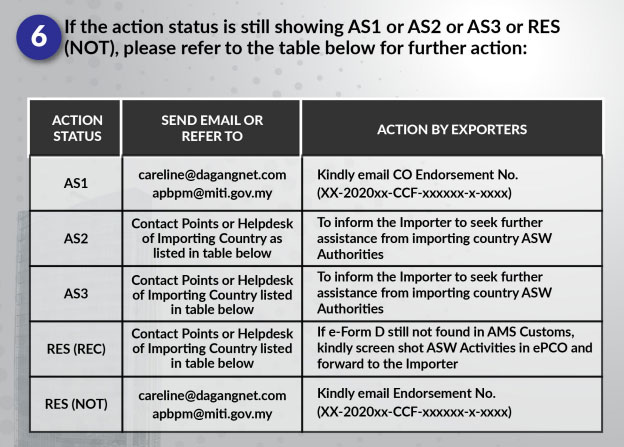

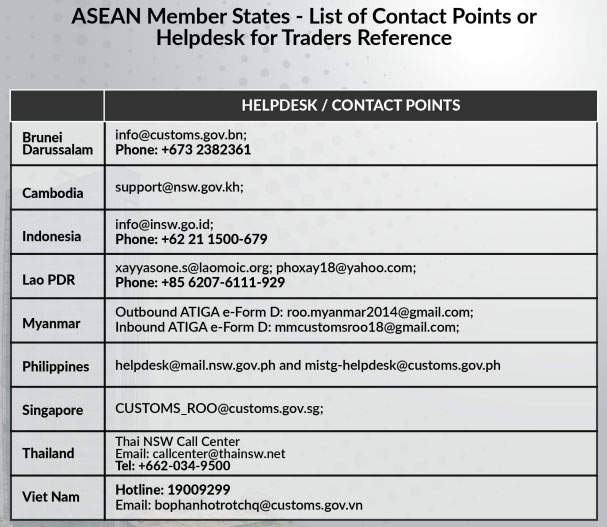

What to do if the ATIGA e-Form D transaction failed?

How to check the ATIGA e-Form D transaction status in the e-PCO System?

Related Documents

ASEAN Wide Self-Certification (AWSC) scheme

The First Protocol to Amend the ASEAN Trade in Goods Agreement (ATIGA) which includes Annex 8 - ATIGA Operational Certification Procedure-OCP has entered into force on 21 August 2020. Subsequent to this, AMS during the SEOM Preparatory Meeting for the 34th AFTA Council Meeting held on 22-23 August 2020, taking into consideration the final ratification instrument received, agreed to implement the ASEAN-Wide Self Certification (AWSC) effective 20 September 2020.

AWSC allows exporters who have demonstrated their competence to comply with the ATIGA Rules of Origin requirements, known as Certified Exporters (CE), to self-certify the origin status for their goods on certain commercial documents such as the invoice, bill of lading, delivery order or packing list instead of applying for a paper-based Certificate of Origin (FORM D) or e-Form D.

How to become a Certified Exporter

Step 1 - Check your eligibility

-

Exporter must be a manufacturer or trader registered with MITI through the ePCO system;

-

Know and understand the Rules of Origin in the ATIGA;

-

Has shown a substantial amount of experience in export procedures and good track record of exporting (the product for which authorization to self-certify is being secured) to ASEAN Member States for the last 24 months.

-

Has no record of any Rules of Origin fraud;

-

Has a sound bookkeeping and record-keeping system;

-

Has shown good compliance as measured by risk management rules where the product Cost Analysis (CA) approval is valid for at least 12 months from the date of appointment; and

-

A trader must have:

-

a “manufacturer’s declaration” indicating the origin of the product to be subject to self-certification and readiness of the manufacturer to cooperate in retroactive check and verification visit should the need arise; and

-

a “trader’s declaration” proving that he/she has a staff competent on ROO, a sound bookkeeping and record-keeping system, and readiness to cooperate in retroactive check/verification mechanism should the need arise.

-

Step 2 - Apply as a Certified Exporter

-

Submit your application by filling up the AWSC Certified Exporter Application Form and Appendix A – Product Information Form and email to atiga.selfcert@miti.gov.my.

-

Applicants will be informed of the result after the evaluation process has completed.

-

Appointed CE will be given an authorisation in writing, to self-certify the origin status for their goods and be granted with an authorisation code which must be included in the Origin Declaration.

-

CE may proceed to self-certify and make an Origin Declaration only for the goods that the CE has been authorised to make and for which the CE has all appropriate documents proving the originating status.

Note: Certified Exporters under SCPP1 will be re-evaluated under the new criteria within the period of 20 September until 31 December 2020. Other exporters who are interested may apply starting

1 January 2021.

Step 3 - Continue to observe all the obligations as a CE

-

Apply for the necessary Cost Analysis approval from MITI (CA validity is 2 years from date of approval);

-

Report to MITI on numbers of Commercial Invoice Declaration on quarterly basis before 5th of April, July, October and January;

-

Keep and maintain up-to-date accurate books and records for at least 3 years;

-

Extend full co-operation to MITI and Royal Malaysian Customs when required (retroactive checks and verification visits) including granting access to records and premises;

-

continue to comply with the conditions set out in Rule 12A (2) of this Rule;

-

accept full responsibility for all Origin Declarations made, including any misuse; and

-

promptly inform the Competent Authority of any changes related to the information submitted under Rule 2(4) of the ATIGA OCP.

Related Documents and Useful Links

Tatacara Pengesahan Sijil Tempasal Berkeutamaan (PCO) Bagi Syarikat Sepanjang Tempoh PKPB

1. Apakah jenis borang Sijil Tempasal Berkeutamaan (Preferential Certificate of Origin (PCO)) yang dibenarkan bagi tatacara ini?

ASEAN-China (Form E)

ASEAN-Japan (Form AJ)

ASEAN-India (Form AI)

Malaysia-Pakistan (Form MPCEPA)

Malaysia-New Zealand (Form MNZFTA)

Malaysia-Chile (Form MCFTA)

Malaysia-India (Form MICECA)

Malaysia-Australia (Form MAFTA)

Malaysia-Turkey (Form MTFTA)

Generalised System of Preferences (GSP) (Form A)

2. Bagaimana pula pengesahan ke atas PCO secara elektronik yang di laksanakan oleh MITI baru-baru ini?

Hanya terpakai kepada skim berikut:

ASEAN-Korea (Form AK)

The ASEAN-Australia-New Zealand (Form AANZ)

ASEAN-Hong Kong (Form AHKFTA)

Malaysia-Japan (Form MJEPA)

Bagi skim ATIGA (Form D), pengesahan ke atas borang (paper-based) ditangguhkan sehingga Operational Certification Procedure (OCP) baharu ATIGA berkuatkuasa (dijangka pada 1 September 2020). Mohon rujuk perkara 6 untuk pengesahan semasa.

3. Bilakah tempoh tatacara ini berkuatkuasa?

Mulai 4 Mei 2020.

4. Adakah kaunter Menara MITI/Pejabat MITI Wilayah telah dibuka seperti biasa untuk tatacara ini?

Tidak. Pengesahan PCO masih dilaksanakan secara back-office sepanjang tempoh ini.

5. Adakah PCO Form D ATIGA dibenarkan untuk pengesahan secara manual atau elektronik?

Tidak. Syarikat hendaklah menggunakan platform e-Form D.

6. Jadi, bagaimana syarikat hendak membuat pengesahan Form D ATIGA?

Rujuk gambarajah dibawah.

7. Pelabuhan negara pengimport tidak menerima pengesahan e-Form D ATIGA di bawah platform ASW, apa yang perlu syarikat lakukan?

Rujuk senarai pelabuhan di Lampiran A.11 dan Lampiran A.12.

8. Kastam negara pengimport tidak menerima data transaksi e-Form D ATIGA daripada MITI, apa yang perlu syarikat lakukan?

Emelkan kepada apbpm@miti.gov.my dan careline@dagangnet.com serta salinan kepada allatiga@miti.gov.my. Syarikat juga boleh menghubungi Careline DagangNet di talian 1-300-133-133.

9. Perlukah syarikat menunggu di Menara MITI/Pejabat MITI Wilayah bagi mendapatkan semula PCO yang telah disahkan?

Tidak perlu.

10. Bolehkah syarikat menghantar PCO selain daripada hari dan waktu yang ditetapkan?

Tidak.

11. Bolehkah syarikat mengambil semula PCO pada hari yang sama?

Tidak. Sila rujuk jadual yang dinyatakan dalam Siaran Media tatacara ini. Contoh: PCO yang dikemukakan pada hari Rabu hanya boleh diambil pada hari Jumaat minggu yang sama.

12. Adakah syarikat dibenarkan untuk membuat penghantaran PCO secara kurier ke Menara MITI/Pejabat MITI Wilayah?

Dibenarkan kecuali Pejabat MITI Melaka. Syarikat perlu melampirkan sampul surat pra bayar bersaiz A4 yang lengkap bersetem dengan alamat sendiri bagi tujuan pemulangan CO.

13. Bagaimana pula dengan kurier ke Pejabat MITI Melaka?

Tidak dibenarkan. Hanya permohonan pengesahan PCO secara serahan tangan sahaja dibenarkan.

14. Saya telah menghantar PCO seperti jadual ditetapkan tetapi mengapa PCO tersebut tidak disahkan?

Syarikat boleh merujuk kepada catatan yang dilampirkan bersama PCO bagi justifikasi penolakan pengesahan.

15. Justifikasi yang diberikan kurang jelas. Bolehkah syarikat membuat temujanji bersama pegawai untuk mendapatkan maklumat lanjut?

Tidak. Syarikat boleh mengemukakan pertanyaan melalui e-mel pco@miti.gov.my

16. Saya turut mempunyai soalan berkenaan Non-Preferential Certificate of Origin (NPCO), bagaimana untuk saya menghubungi pegawai MITI?

Syarikat boleh mengemukakan pertanyaan melalui e-mel npco@miti.gov.my

17. Saya tidak dapat memuatnaik dokumen pada sistem ePCO semasa permohonan PCO/Cost Analysis (CA).

Bagi sebarang bantuan teknikal untuk sistem ePCO, syarikat boleh menghubungi Careline DagangNet yang beroperasi 24 jam di talian 1-300-133-133 atau melalui e-mel careline@dagangnet.com

18. Adakah tatacara ini turut akan disambung sekiranya tempoh PKPB atau PKP dilanjutkan oleh Kerajaan?

Pihak syarikat di mohon untuk sentiasa merujuk kepada kemaskini pemakluman MITI di laman sesawang dan platform media sosial dari masa ke semasa.

Implementation Of Electronically Affixed Signature And Official Seal Through The ePCO System

1. Which FTA schemes implemented the electronically affixed signature and official seal through the ePCO system?

MITI had implemented electronically affixed signatures and official seals through the ePCO system since April 2020 for the FTA scheme as follows:

- Malaysia - Japan Economic Partnership Agreement (Form MJEPA);

- ASEAN - Australia - New Zealand Free Trade Area (Form AANZ);

- ASEAN - Hong Kong, China Free Trade Agreement (Form AHK);

- ASEAN - Korea Free Trade Area (Form AK);

- ASEAN Trade in Goods Agreement (Form D); and

- Malaysia - New Zealand Free Trade Agreement (Form MNZ).

In 2022, this initiative has been extended to the FTA schemes as follows:

- Regional Comprehensive Economic Partnership Agreement (Form RCEP);

- Comprehensive and Progressive Agreement for Trans-Pacific Partnership (Form CPTPP);

- ASEAN - China Free Trade Area (Form E);

- ASEAN - India Free Trade Area (Form AI);

- Malaysia - India Comprehensive Economic Cooperation Agreement (Form MICECA); and

Malaysia - Turkey Free Trade Agreement (Form MTFTA).

2. Which FTA scheme has not implemented electronically affixed signature and official seal?

- Malaysia - Pakistan Closer Economic Partnership Agreement (Form MPCEPA);

- Malaysia - Australia Free Trade Area (Form MAFTA);

- Malaysia - Chile Free Trade Area (Form MCFTA); and

- ASEAN - Japan Comprehensive Economic Partnership Agreement (Form AJCEP).

3. What is the printing requirement of the approved Preferential Certificate of Origin (PCO) with an electronically affixed signature and MITI official seal?

The approved PCO shall be printed according to the schemes as follows:

|

No |

Scheme |

Requirement |

|

a) |

ASEAN Trade in Goods Agreement (Form D) |

Print on ISO A4 size white paper |

|

b) |

ASEAN - China Free Trade Area (Form E) |

|

|

c) |

ASEAN - Hong Kong, China Free Trade Agreement (Form AHK) |

|

|

d) |

Regional Comprehensive Economic Partnership Agreement (Form RCEP) |

|

|

e) |

Comprehensive and Progressive Agreement for Trans-Pacific Partnership (Form CPTPP) |

|

|

f) |

Malaysia - New Zealand Free Trade Agreement (Form MNZ) |

Print on the form supplied by Federation of Malaysian Manufacturers (FMM) |

|

g) |

ASEAN - Australia - New Zealand Free Trade Area (Form AANZ) |

|

|

h) |

ASEAN - Korea Free Trade Area (Form AK) |

|

|

i) |

Malaysia - Japan Economic Partnership Agreement (Form MJEPA) |

|

|

j) |

ASEAN - India Free Trade Area (Form AI) |

|

|

k) |

Malaysia - India Comprehensive Economic Cooperation Agreement (Form MICECA) |

|

|

l) |

Malaysia - Turkey Free Trade Agreement (Form MTFTA) |

4. Who should sign and endorse the PCO in the exporter’s declaration section?

The person authorised by the company/exporter needs to sign and endorse the PCO.

5. Which approved PCO should get manual endorsement from MITI?

Exporter should get the manual endorsement for approved PCO under the FTA schemes as follows:

- Malaysia - Pakistan Closer Economic Partnership Agreement (Form MPCEPA);

- Malaysia - Australia Free Trade Area (Form MAFTA);

- Malaysia - Chile Free Trade Area (Form MCFTA); and

- ASEAN - Japan Comprehensive Economic Partnership Agreement (Form AJCEP).

6. When should exporter submit duplicate copy of PCO to MITI?

The duplicate copy of PCO with electronically affixed signature and seal should be endorsed by exporter and submitted to MITI on a monthly basis.

7. Which FTA scheme that does not require submission of duplicate copy to MITI?

As per MITI’s announcement, only Form CPTPP not required to be submitted but exporter shall keep it as record for a period of not less than 5 years.

8. What type of duplicate copy of PCO to be submitted to MITI?

Exporter shall endorse and submit duplicate copy of PCO printed in black and white to MITI.

9. Has MITI notified the importing country authority about the implementation of electronically affixed signature and official seal through the ePCO System?

MITI has notified the relevant importing country authority officially before the date of implementation.

10. What is the function of QR Code on the PCO?

The QR Code provides easy access to importing country authority to verify PCO issued by MITI.

11. Who is authorised to access COO Verification System (CVS)?

Only the relevant importing country authorities are allowed to access CVS.

12. Where should exporter submit the duplicate copy of PCO?

Duplicate copy of the PCO should be submitted to MITI at the following address:

Trade and Industry Support Division

Ministry of International Trade and Industry

Menara MITI

No.7, Jalan Sultan Haji Ahmad Shah

50480 Kuala Lumpur

(Attn: MITI Service Counter, Level 2)

or nearest MITI Regional Office

13. What type of approved PCO need to be presented to the importing country authority?

Exporter has to produce original copy of PCO. However, exporter needs to confirm with the importing country authority on the acceptance of coloured or non-coloured PCO.

14. What should exporter do to the approved PCO for all FTA schemes?

It is compulsory for exporter to send original copy of PCO in hardcopy to importing country authority through any method deem necessary i.e. courier.

15. Which FTA scheme allows submission of softcopy of PCO to importing country authority?

Only Form CPTPP in PDF format is allowed to be submitted to the importing country authority.

Proses Alternatif Untuk Pengesahan Sijil Tempasal Bagi Syarikat Sepanjang Tempoh Perintah Kawalan Pergerakan (PKP)

1. Apakah jenis borang CO yang dibenarkan bagi proses ini?

- ASEAN-China (Form E)

- ASEAN-Rep. of Korea (Form AK)

- ASEAN-Japan (Form AJ)

- ASEAN-India (Form AI)

- ASEAN-Australia-New Zealand (Form AANZ)

- ASEAN-Hong Kong (Form AHKFTA)

- Malaysia-Japan (Form MJEPA)

- Malaysia-Pakistan (Form MPCEPA)

- Malaysia-New Zealand (Form MNZFTA)

- Malaysia-Chile (Form MCFTA)

- Malaysia-India (Form MICECA)

- Malaysia-Australia (Form MAFTA)

- Malaysia -Turkey (Form MTFTA)

- Generalised System of Preferences / GSP (Form A)

2. Adakah CO Form D ATIGA dibenarkan untuk pengesahan secara manual?

Tidak. Syarikat hendaklah menggunakan e-Form D.

3. Jadi, bagaimana syarikat hendak membuat pengesahan Form D ATIGA?

Rujuk gambarajah dibawah.

.bmp)

4. Pelabuhan negara pengimport tidak menerima pengesahan e-Form D ATIGA di bawah platform ASW, apa yang perlu syarikat lakukan?

Rujuk senarai pelabuhan di LAMPIRAN A11 dan LAMPIRAN A12.

5. Kastam negara pengimport tidak menerima data transaksi e-Form D ATIGA daripada MITI, apa yang perlu syarikat lakukan?

Emelkan kepada apbpm@miti.gov.my dan careline@dagangnet.com serta salinan kepada allatiga@miti.gov.my

6. Bilakah tempoh proses alternatif ini berkuatkuasa?

Mulai 30 Mac 2020 hingga 14 April 2020.

7. Perlukah syarikat menunggu di Menara MITI/Pejabat MITI Wilayah bagi mendapatkan semula CO yang telah disahkan?

Tidak perlu.

8. Bolehkah syarikat menghantar CO selain daripada hari dan waktu yang ditetapkan?

Tidak.

9. Adakah syarikat dibenarkan untuk membuat penghantaran CO secara kurier ke pejabat MITI?

Tidak dibenarkan. Kelonggaran kurier hanya diberikan kepada CO yang sebelum ini dikemukakan ke kaunter MITI Melaka.

10. Bagi CO dari Melaka yang perlu dikurier, adakah saya perlu kurier kepada Pejabat MITI Johor dan Menara MITI?

Tidak. Syarikat hanya perlu kurier kepada Pejabat MITI Johor ATAU Menara MITI.

11. Kenapa syarikat tidak menerima pemulangan CO yang telah dikurier?

Syarikat perlu melampirkan sampul surat pra bayar bersaiz A4 yang lengkap bersetem dengan alamat sendiri bagi tujuan pemulangan CO.

12. Saya telah menghantar CO seperti jadual ditetapkan tetapi mengapa CO tersebut tidak disahkan?

Syarikat boleh merujuk kepada catatan yang dilampirkan bersama CO bagi justifikasi penolakan pengesahan.

13. Justifikasi yang diberikan kurang jelas. Bolehkah syarikat membuat temujanji bersama pegawai untuk mendapatkan maklumat lanjut?

Tidak. Syarikat boleh mengemukakan pertanyaan melalui emel allofficerskpi@miti.gov.my

14. Adakah proses alternatif ini turut akan disambung sekiranya tempoh PKP dilanjutkan oleh Kerajaan?

Pihak syarikat di mohon untuk sentiasa merujuk kepada kemaskini pemakluman MITI di laman sesawang dan platform media sosial dari masa ke semasa.

Self-Certification System Under ATIGA

What is Self-Certification System?

Self-Certification is an export system that enables the Certified Exporters to make an Invoice Declaration on the Origin of the products to be exported on their own.

What is the different between Self-Certification system and conventional ATIGA Form D?

-

The information in the invoice declaration is less than what appears in ATIGA Form D.

-

It will gradually replace the conventional ATIGA Form D which is currently being issued by MITI.

To which ASEAN member countries I can just use invoice declaration to prove the origin of my goods?

Invoice declaration can only be used with ASEAN member countries in the same pilot project group as Malaysia i.e. Brunei, Cambodia, Singapore, Thailand and Myanmar.

How can I become a Certified Exporter in order to utilize the Self-Certification system?

-

Application to become a Certified Exporter must be made to MITI (ATIGA Self-Cert Secretariat, SKPI, MITI KL)

-

More information and applications documents can be obtained from the webpage: https://www.miti.gov.my/index.php/pages/view/1803?mid=100

What are the criteria to apply for Certified Exporter?

-

Exporter is a registered user of the ePCO system;

-

Exporter is currently utilising Form D to Brunei, Cambodia, Myanmar, Singapore & Thailand;

-

Exporter has approved Cost Analysis that is still valid for at least 12 months from the date of appointment;

-

Exporter has good track record for PCO application / utilization for the last 24 month; and

-

Exporter is fully aware and understands the ATIGA’s Rules of Origin (ROO).

Can I apply to become a Certified Exporter if I’m a Trader?

Yes, a Trader may apply to become a Certified Exporter on the conditions:

-

Trader is a registered user of ePCO system;

-

Trader is to have a MOU with manufacturers to ensure originating status of products; and

-

Manufacturer’s status is proven with their Manufacturing License.

What is my obligation as the appointed Certified Exporter?

Certified Exporter is responsible to undertake the followings:

-

To be responsible with the products Origin Criterion declared;

-

To keep and maintain an up-to-date accurate books and records for at least 3 years;

-

To report to MITI the statistics of Commercial Invoice Declaration on a quarterly basis before 5th day of the month;

-

To extend a full cooperation to MITI and Royal Malaysian Customs Department (RMCD); and

-

To allow Officers from MITI and RMCD to inspect / audit the factory and operations as and when required.

What would happen if I fail to observe my undertakings as a Certified Exporter?

Failure to comply with the specified undertakings may result in the termination of appointment as a Certified Exporter.

Preferential Certificate Of Origin (PCO)

What is Preferential Certificate of Origin (PCO)?

A Preferential Certificate of Origin (PCO) is a document to prove the origin status of a product which also acts as an import document to the customs of importing country in order for a product to enjoy tariff concession.

What is the benefit of using PCO for export?

A Preferential Certificate of Origin allows your buyer to pay lower or total removal of customs duty when you export your goods under a Free Trade Agreement (FTA) or Scheme of Preferences.

To which country I can use the PCO for export?

A Preferential Certificate of Origin can be issued to countries where Malaysia has Free Trade Agreement (FTA) with. List of countries and their FTAs can be viewed at the following link http://fta.miti.gov.my/

What certificate I can use for export to non FTA member countries?

You can use the Non-Preferential Certificate of Origin (NPCO) for export to non-FTA member countries, where Malaysia does not have any Free Trade Agreement (FTA) with.

What is the difference between Preferential Certificate of Origin (PCO) and Non Preferential Certificate of Origin (NPCO)?

Both Preferential Certificate of Origin (PCO) and Non Preferential Certificate of Origin (NPCO) would prove the origin status of a product. However Non Preferential Certificate of Origin does not qualify a product to enjoy tariff concession.

Which Preferential Certificate of Origin (PCO) form should I use?

Exporters are advised to study the agreement before applying a Preferential Certificate of Origin to determine which FTA will benefit them the most. Usually type of form will depend on destination to export and origin of local contents of a product. Forms under their FTAs are as follows:-

|

Free Trade Agreements (FTA) |

Form |

|

ATIGA |

FORM D |

|

AIFTA |

FORM AI |

|

AKFTA |

FORM AK |

|

AJCEP |

FORM AJ |

|

AANZFTA |

FORM AANZ |

|

ACFTA |

FORM E |

|

GSP |

FORM A |

|

MJEPA |

FORM MJEPA |

|

MPCEPA |

FORM MPCEPA |

|

MNZFTA |

FORM MNZ |

|

MAFTA |

FORM MAFTA |

|

MTFTA |

FORM MTFTA |

|

MCFTA |

FORM MCFTA |

|

MICECA |

FORM MICECA |

Where can I get the Preferential Certificate of Origin (PCO) form?

The form can be purchased at all FMM Branches all over Malaysia.

Where can I get the Non-Preferential Certificate of Origin (NPCO) form?

The form can be applied from any chambers / associations appointed by MITI.

What are the supporting documents required for Preferential Certificate of Origin (PCO) form application?

Supporting documents for application of CO for GSP/CEPT/AICO/ACFTA/MPCEPA/MJEPA/AKFTA are:

Before Export

-

Invoices to customer

-

Packing List

After Export

-

Invoices to customer

-

Packing List

Bill of Lading

Custom’s Declaration Form K2

Do I need to print on Preferential Certificate of Origin (PCO) form?

Yes, you will need to print on CO form and submit the form to MITI for endorsement.

Must I attach hardcopy of supporting documents when submitting Preferential Certificate of Origin (PCO) form to MITI for endorsement?

No, all supporting documents are required to be attached online, during your application in the system.

How long would it take for MITI to process my Preferential Certificate of Origin (PCO) application?

The client charter set by MITI for Preferential Certificate of Origin (PCO) is 24 working hours.

How should I issue the commercial invoice in order for me to apply for a PCO?

The commercial invoice must be issued with Company’s stamping and signature.

How should I declare the products / items in the Preferential Certificate of Origin (PCO) application when I have more than one (1) product / item (multiple products / items) listed in one (1) commercial invoice?

If application is made for one (1) Preferential Certificate of Origin (PCO), each product / item must be declared separately per item as each product (item) qualifies in its own right.

How should I declare the product / item in the Preferential Certificate of Origin (PCO) application when I have more than one (1) commercial invoices issued for one (1) product / item?

Declaration must be made as per one (1) product, one (1) invoice (reference no & date).

Can I apply for Preferential Certificate of Origin (PCO) before I export my product?

Yes, application can be made under Pre-exportation PCO Application.

How should I apply the Pre-exportation Preferential Certificate of Origin (PCO) Application?

-

Application is made not more than 14-days prior to the actual exportation date;

-

Exporters must have a confirmed shipment date before applying for pre-exportation PCO. If application is made without having a confirmed shipment date, the exporters would need to submit new PCO application if actual shipment date is different from the shipment date declared in the pre-exportation PCO;

-

The required documents are commercial invoice and packing list; and

-

The Bill of Lading (BL) and Customs endorsed K2 must be submitted through the ePCO system within the period of 2 weeks from the date of approval. Failure to do so, future pre-exportation PCO application may be rejected by MITI.

What are the required documents if I want to apply Preferential Certificate of Origin (PCO) for exportation by hand-carry?

The required documents are commercial invoice; packing list / company’s declaration letter; K2; and airline ticket.

Can I just submit a draft copy of the Customs declaration i.e. K2 as supporting document for my Preferential Certificate of Origin (PCO) application?

-

For PCO application, exporters are required to submit a Customs endorsed K2 form together with K2 Chit in the application. A draft K2 is not acceptable for PCO application.

-

Any amendment made to the Customs endorsed K2 form must be approved or endorsed by Royal Malaysia Customs Department (RMCD) and amendment form from RMCD must be attached.

Which date should I use to declare the shipment date in the Preferential Certificate of Origin (PCO) application?

The shipment date declared in the PCO should be based on the Shipped on Board (SOB) date stated in the Bill of Lading.

Would it be okay if the shipment / export date in the Customs document K2 is different from the date of shipped on board in the Bill of Lading?

The difference in the shipment / export date between Customs document K2 and Bill of Lading is acceptable as MITI takes into consideration that the Royal Malaysia Customs Department (RMCD) allows Exporters to make advance export declaration.

What should I do if the Preferential Certificate of Origin (PCO) is lost before Customs clearance at the Importing country?

-

Exporter must NOT make a new application for the same consignment to replace the lost PCO as this may invoke confusion and duplication of consignment details at the Importing Party’s side;

-

Exporter is to reprint the approved PCO from the ePCO System and to get endorsement from MITI. The reprinted PCO shall bear “CERTIFIED TRUE COPY” (to be stamped by MITI) in order to differentiate the first original copy and the reissued original CO due to the loss; and

-

Upon endorsement, company shall present a letter of explanation to MITI on the request made for the “CERTIFIED TRUE COPY” accompanied with a police report on the lost PCO.

What should I do if I want to cancel an approved and endorsed Preferential Certificate of Origin (PCO)?

-

The complete set of the approved and endorsed PCO (ORIGINAL & TRIPLICATE copy) must be returned to MITI for cancellation purposes;

-

The said PCO must not yet been surrendered to the Importing Customs and is yet to be utilized;

-

No new PCO application (as replacement) is allowed if Company fails to return the said PCO;

-

Once the said PCO has been returned, application for cancellation must be made through the ePCO system and make new PCO application (as replacement);

-

Actions as mentioned above must be done to avoid the issuance of 2 PCO for the same shipment; and

-

PCO that has been denied preferential treatment by Importing Customs cannot be cancelled and no replacement of PCO can be made.

Cost Analysis

What is Cost Analysis (CA)?

The flow of production cost of a product produced by a manufacturer that is used to identify the original value content in a product before an origin status is granted. It is subjected to the ROO regulated by each FTA.

What is the purpose of Cost Analysis (CA)?

Purpose of Cost Analysis (CA) is to determine whether your product can comply with Rules of Origin to be issued with Preferential Certificate of Origin.

How to apply Cost Analysis (CA)?

All application for Cost Analysis (CA) can be made online via http://newepco.dagangnet.com.my/

How long would it take for MITI to process my Cost Analysis (CA) application?

The client charter set by MITI for Cost Analysis (CA) application is 5 working days.

Declaration of origin for raw materials in Cost Analysis.

Under Regional FTAs, for raw materials declared as originating from ASEAN countries, the declaration of origin must be supported with PCO form under the respective Regional FTAs. If PCO form is not available, Exporters are advised to declare the origin as ‘UNDETERMINED’.

Attachment of Manufacturing Licence (ML)

-

ML is one of the mandatory document to be attached when applying for CA in order to prove that Manufacturer is allowed under the law or related regulations to do manufacturing activity of the goods to be applied for in the CA application;

-

ML issued by MIDA must feature clearly the signature and the name of the Signatory;

-

If, Manufacturer is not eligible for the ML issued by MIDA, Manufacturer may submit its valid business licence (issued by local authority where Manufacturer is operating) in which the business licence must indicate Manufacturer is licensed to do manufacturing / processing activity of the goods; and

-