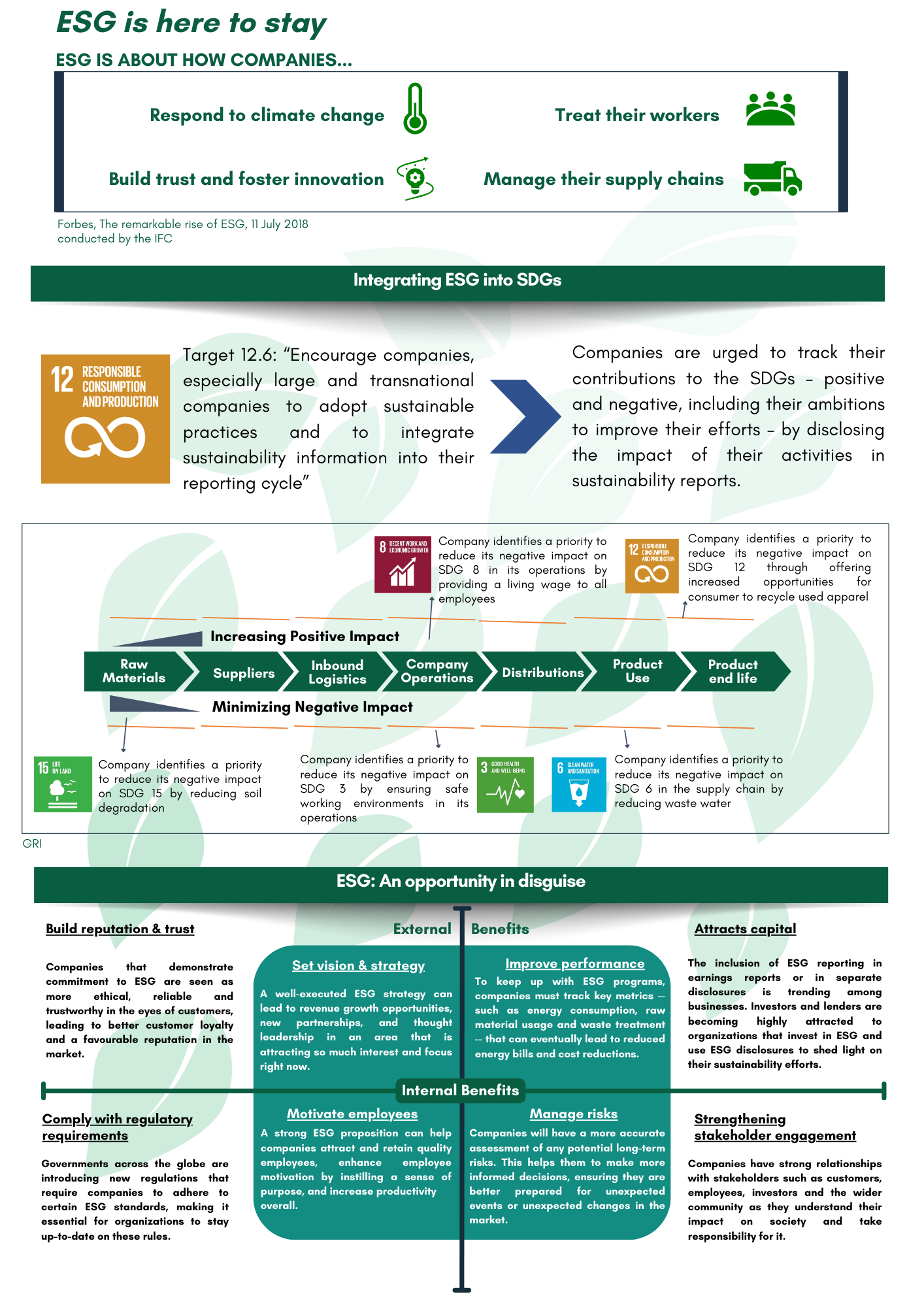

What is ESG?

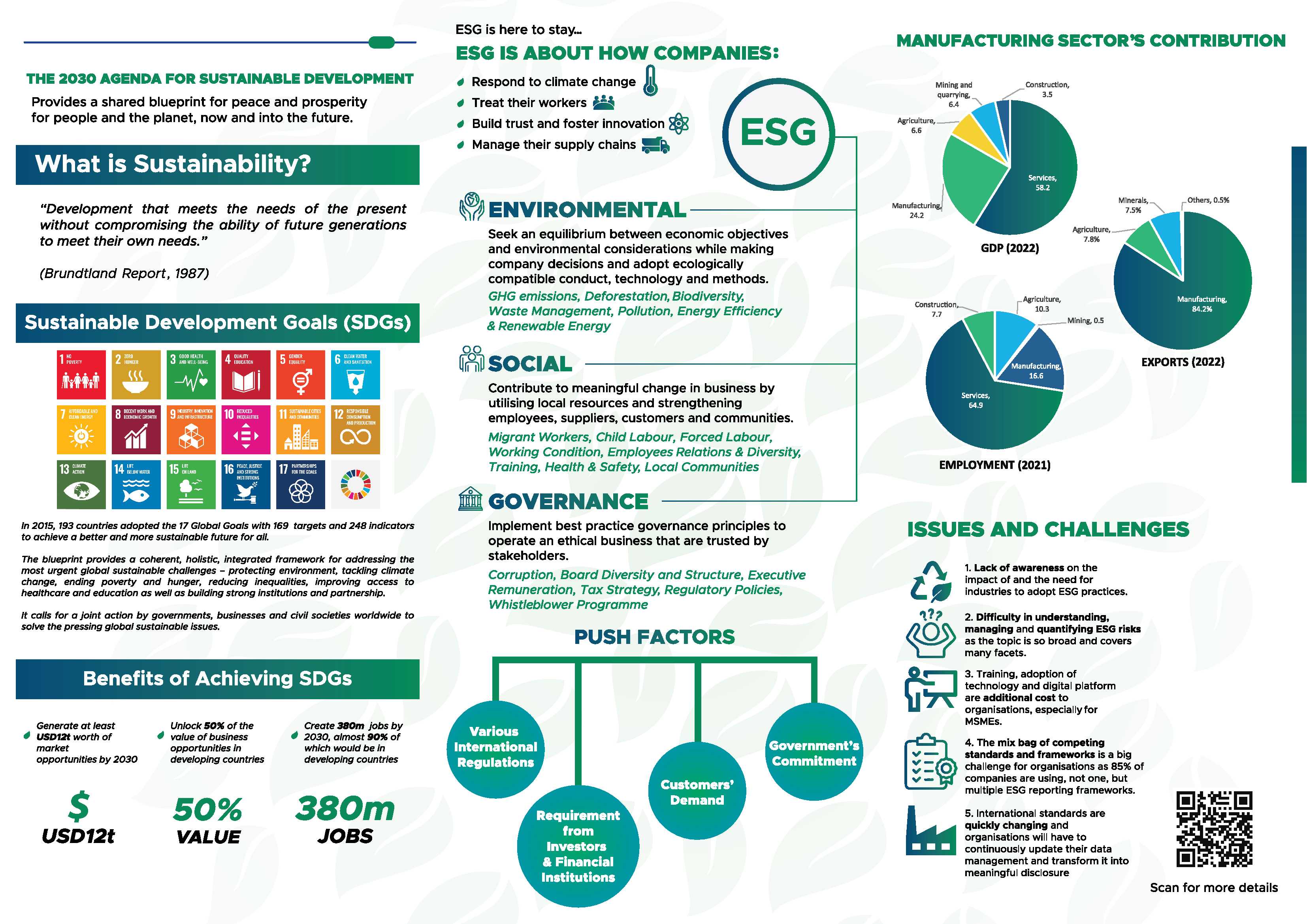

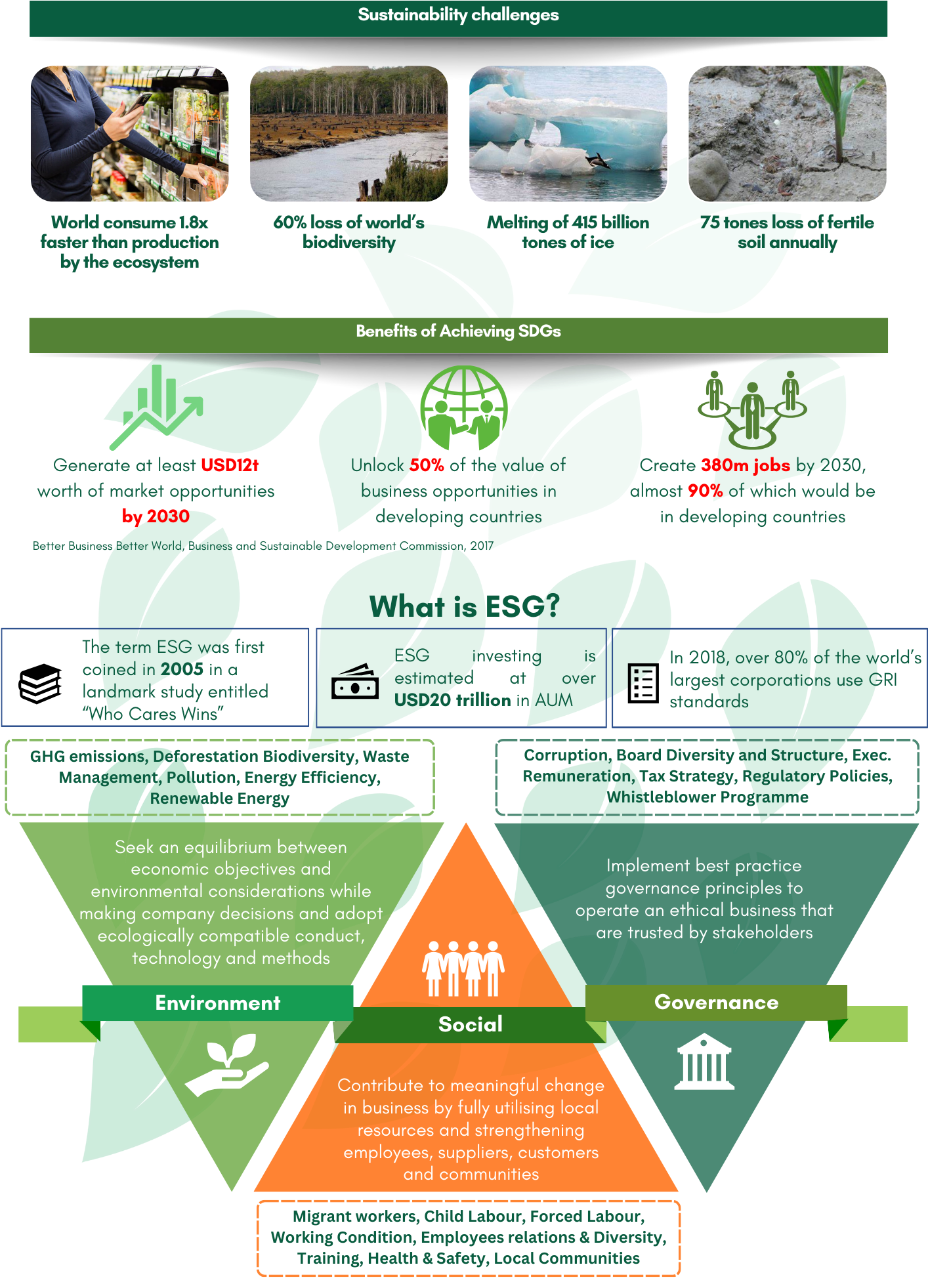

ESG stands for Environmental, Social, and Governance. ESG factors are a set of non-financial metrics that are increasingly being used to assess the sustainability and long-term value of companies. This include how companies respond to climate change, how they treat their workers, how they manage their supply chains and how they build trust and fosters innovation.

The term ESG was first coined in in a landmark 2004 report published jointly by the United Nations and Swiss Federal Department of Foreign Affairs entitled “Who Cares Wins: Connecting Financial Markets to a Changing World”. The report is the result of a joint initiative of financial institutions which were invited by United Nations Secretary-General Kofi Annan to develop guidelines and recommendations on how to better integrate environmental, social and corporate governance issues in asset management, securities brokerage services and associated research functions.

Eighteen financial institutions from 9 countries with total assets under management of over 6 trillion USD have participated in developing the report. The initiative is supported by the chief executive officers of the endorsing institutions. The UN Global Compact oversaw the collaborative effort that led to this report and the Swiss Government provided the necessary funding.

What are the components of ESG?

Environmental - Greenhouse gasses (GHG) emission, deforestation, biodiversity, water and waste management, pollution, energy efficiency, renewable energy, etc.

Social - Migrant workers, child and forced Labour, working and living condition, employees’ relations, diversity, training, health & safety, local communities, etc.

Governance - Corruption, board diversity and structure, executive remuneration, tax strategy, regulatory policies, whistle blowing, etc.

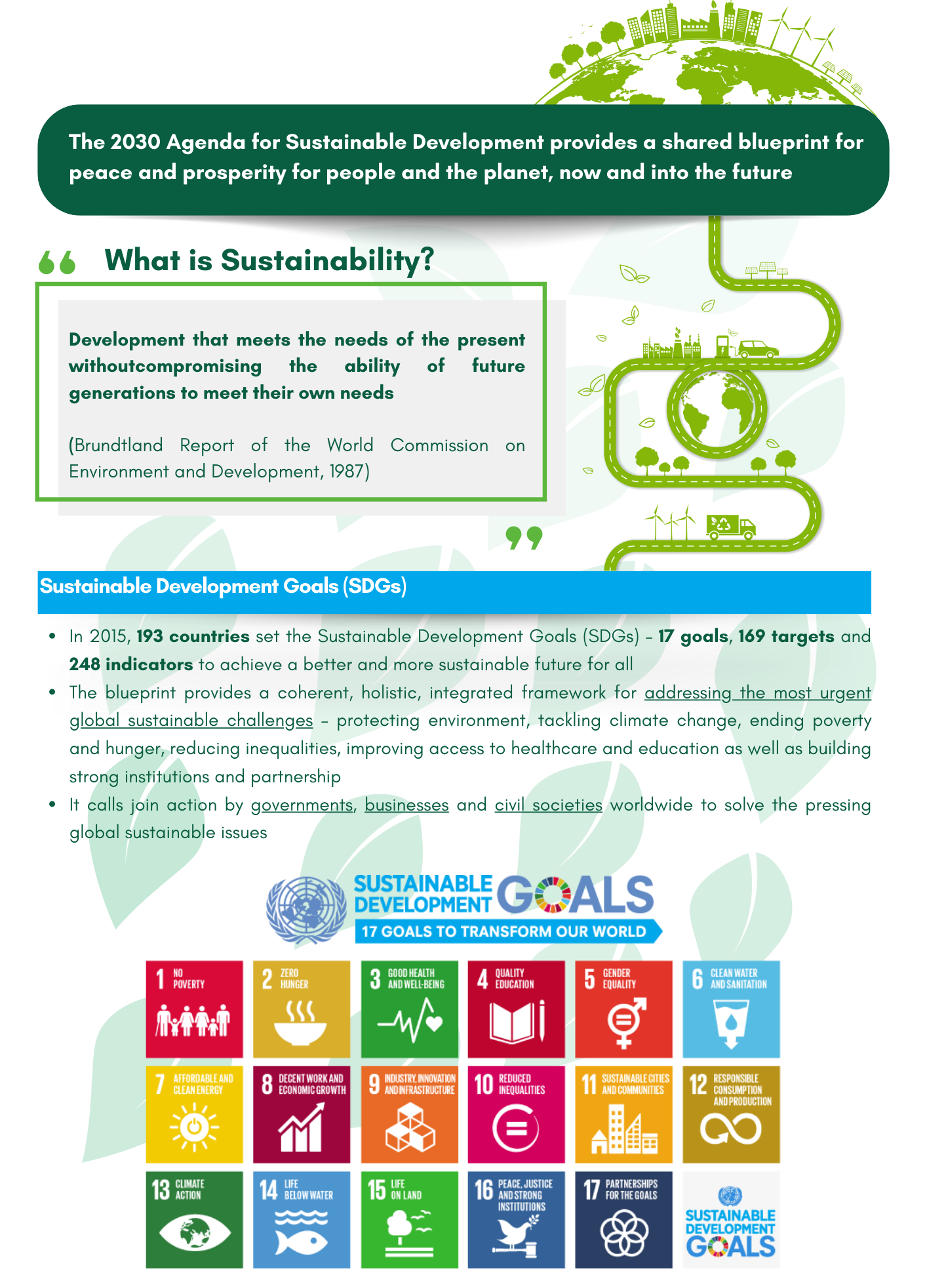

What is SDG?

SDG stands for Sustainable Development Goals. It is a set of 17 goals that were adopted by the United Nations in 2015 to address global challenges such as poverty, hunger, climate change and inequality. SDG is closely linked with ESG because they both aim to achieve a sustainable and equitable future for all.

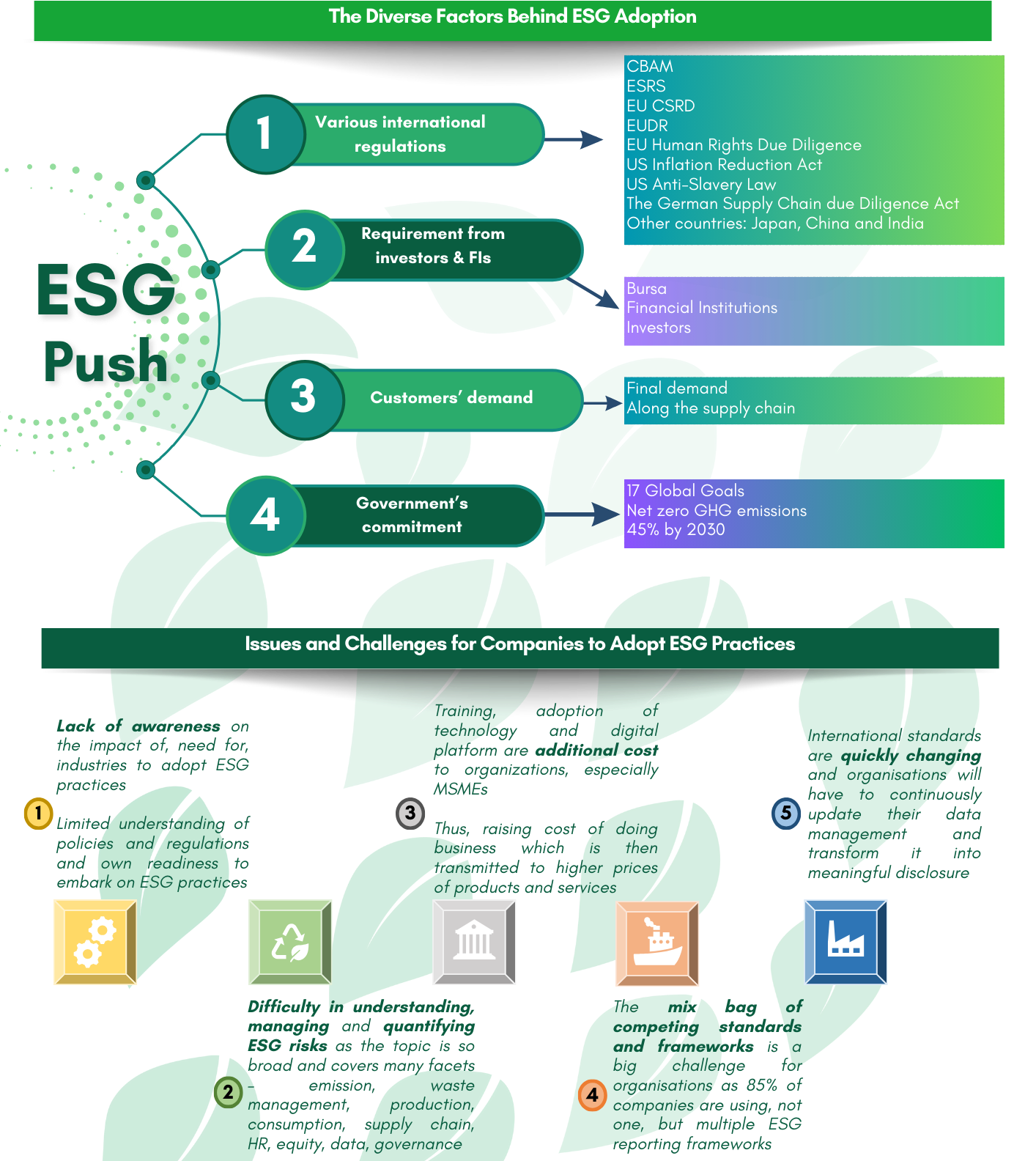

What are the push factors for ESG adoption in Malaysia?

a. Various international regulations

Exports are a major driver of economic growth in Malaysia and contribute significantly to National’s GDP. Among Malaysia’s major export markets are ASEAN

countries, China, the United States (US), Japan and the European Union (EU). As such, export products from Malaysia are subjected to various international regulations related to ESG that may prevent them from entering the importing countries.

Therefore, complying with these regulations will enable Malaysian companies to continue accessing international markets and participate in the global supply chains. Among these regulations are the European Green Deal, Carbon Border Adjustment Mechanism (CBAM), EU Deforestation Regulation (EUDR), Corporate Sustainability Reporting Directive (CSRD), European Sustainability Reporting Standards (ESRS), EU Human Rights Due Diligence, US Inflation Reduction Act, US Anti-Slavery Law, The German Supply Chain due Diligence Act and many more.

b. Requirement from investors & financial institutions

According to a Bloomberg report, global ESG assets climbed from US$22.8 trillion (RM108.07 trillion) in 2016 to US$37.8 trillion in 2021, and this number is forecasted to increase to US$53 trillion by 2025, which would represent one third of total assets under management.

In Malaysia, since the introduction of the first Sustainable and Responsible Investment (SRI) fund in 2018, there are currently around 60 SRI funds in the market, with a combined net asset value of around RM4.8 billion. With a number of upcoming SRI funds in the pipeline, it is expected that it will continue to grow in this up-and-coming segment of the local market.

Financial institutions and investors are increasingly demanding that companies adopt ESG practices. This is because ESG factors are seen as important determinants of long-term financial performance. For example, companies with strong ESG profiles are less likely to be exposed to environmental risks, such as climate change, and are more likely to attract and retain customers and employees.

c. Consumers’ / Customers’ demand

Consumers from various regions and groups are showing a strong interest in adopting eco-friendly behaviours. A survey by GlobeScan in 2021 found that 47% of respondents are willing to make significant lifestyle changes to be more environmentally friendly. The IBM and NRF consumer survey in 2022 showed even higher results, with 62% of consumers expressing their readiness to change their shopping habits to reduce environmental impacts. This was a 5% increase from the same survey conducted in 2020.

Additionally, 77% of respondents said sustainability is crucial to them, and just over 70% are willing to pay more for products that offer health benefits, use organic ingredients, support recycling, or are environmentally responsible (IBM and NRF, 2020). Similarly, in a PwC survey from June 2021, 50% of global consumers stated they consider sustainability features when making purchasing decisions. In the previous year's survey, only 35% of consumers showed a preference for sustainable products.

As consumers along the supply chain are becoming more aware of the environmental and social impact of businesses, the demand for sustainable products and materials are increasing. As a result, companies that do not adopt ESG practices are at a competitive disadvantage. They are less likely to attract and retain customers, and they may also face reputational damage.

d. Government’s commitment

Malaysia has endorsed the Sustainable Development Goals (SDGs) and is committed to achieving the 17 Global Goals by 2030. The government has developed a number of policies and programs to address the challenges facing the country. Apart from that, advancing Sustainability is one of the three themes in the Twelfth Malaysia Plan (12th MP), with focus on advancing green growth, enhancing energy sustainability and transforming the water sector. Among the targets set out in the 12th MP are reducing greenhouse gas (GHG) emissions intensity to GDP by 45% by 2030 compared to 2005 level and increasing the share of renewable energy in total installed capacity to 31% by 2025. Malaysia is also party to the Paris Agreement and aspires to achieve net zero GHG emission by 2050.

ESG vs SDG?

SDGs are the goals set by governments around the world to address sustainability challenges such as climate change, pollution, biodiversity loss, inequality, poverty, human rights etc. Meanwhile, ESG helps companies to identify and manage the risks and opportunities associated with the SDGs. For example, a manufacturing company that is committed to reducing its environmental impact may be better positioned to meet the SDGs related to climate change and sustainable consumption and production.

Similarities between ESG and SDG:

- Both are concerned with the long-term sustainability of businesses and societies.

- Both emphasize the importance of transparency and accountability.

- Both are becoming increasingly important to investors, customers, and other stakeholders.

Differences between ESG and SDG:

- ESG is a more comprehensive framework than SDG. ESG considers a wider range of factors, including environmental, social, and governance. SDG focuses on a narrower range of factors, specifically the 17 goals that were adopted by the United Nations in 2015, focusing on People, Planet, Prosperity, Peace, and Partnerships.

- ESG is more focused on businesses, while SDG is at a macro level which is targeted by the governments. ESG is used to evaluate the performance of businesses, while SDG is used to evaluate the progress of societies towards achieving the 17 goals.

What are some of the challenges of adopting ESG practices for companies in Malaysia?

Lack of awareness: There is currently a lack of awareness on the impact of and need for the adoption of ESG practices as well as limited understanding of policies and regulations and own readiness to adopt ESG practices.

-

Difficulty in understanding, quantifying and managing ESG risks: The ESG topic is so broad and covers many facets – emission, waste management, production, consumption, supply chain, HR, equity, data, governance etc.

-

Cost: Adopting ESG practices can be costly, especially for small and medium-sized enterprises. This is because it can involve investing in new technologies, training employees, and changing business processes.

-

Complexity: ESG practices can be complex and time-consuming to implement. This is because it requires companies to understand a wide range of issues, such as environmental regulations, labour rights, and corporate governance.

-

Lack of expertise: Many manufacturing companies in Malaysia lack the expertise and resources to adopt ESG practices. This is because ESG is a relatively new field and there are limited resources available to help companies implement ESG practices.

-

Resistance from stakeholders: Some stakeholders, such as employees or suppliers, may resist changes to adopt ESG practices. This is because they may be concerned about the costs or the impact on their jobs.

-

Lack of demand: There is currently limited demand for ESG products and services in Malaysia. This is because consumers and businesses are not yet fully aware of the benefits of ESG practices.

-

Competing reporting standards and frameworks: 85% of companies are using, not one, but multiple ESG reporting frameworks.

-

Quick changing international standards: Companies will have to continuously update their data management and transform it into meaningful disclosure to meet changing international standards.

How can companies in Malaysia overcome some of the challenges of adopting ESG practices?

Some of the ways that manufacturing companies in Malaysia can overcome these challenges are:

-

Prioritizing ESG practices: Manufacturing companies should prioritize ESG practices and make them a strategic priority for the company. This will help

-

to ensure that the company has the resources and support it needs to implement ESG practices.

-

Partnering with experts: Manufacturing companies can partner with experts, such as consultants or NGOs, to help them implement ESG practices. This can help the company to get the expertise and resources it needs to overcome the challenges of adopting ESG practices.

-

Communicating with stakeholders: Manufacturing companies should communicate with stakeholders about their ESG practices. This will help to build understanding and support for ESG practices.

-

Educating employees: Manufacturing companies should educate employees about ESG practices. This will help to ensure that employees are committed to ESG practices and that they understand the benefits of ESG practices.

-

Promoting ESG products and services: Manufacturing companies should promote ESG products and services to consumers and businesses. This will help to create demand for ESG products and services and help to overcome the challenges of adopting ESG practices.

What are some of the benefits of adopting ESG practices for companies in Malaysia?

-

Complying with local and international regulations: ESG can help companies to reduce exposure to regulatory risk, improve reputation with stakeholders, increase access to capital and enhance risk management and decision-making processes

-

Attracting and retaining customers: ESG can help companies to improve brand awareness, differentiate from competitors, increase reputation, increase customer loyalty and satisfaction as well as increase employee morale and productivity.

-

Innovating and differentiating themselves from competitors: ESG can be a valuable tool for companies to identify new opportunities for innovation, attract and retain top talent, develop new products and services that meet the needs of the marketplace and gain access to new markets and customers.

-

Building a more resilient supply chain: ESG can help companies to reduce the risk of disruptions, build strong relationship with suppliers, improve transparency and efficiency as well as increase sales and revenue through customer loyalty.

-

Preparing for the future: ESG can be a valuable tool for companies to identify and manage risks, build a more resilient business, attract and retain talent, foster innovation and efficiency, anticipate emerging opportunities as well as adapt to regulatory changes.

-

Improving financial performance: ESG can help companies to improve their financial performance by reducing operating costs, increase efficiency and profitability, improve risk management and enhance reputation and attract more investors and command a higher share price.

How can companies in Malaysia get started with ESG adoption?

Set ESG goals and objectives: The first step is to set ESG goals and objectives that are specific, measurable, achievable, relevant, and time-bound. These goals should be aligned with the company's overall business strategy and should be based on a thorough understanding of the company's ESG risks and opportunities.

-

Identify and assessing ESG risks: Companies should identify and assess their ESG risks. This means understanding the environmental, social, and governance factors that could impact the company's operations, financial performance, and reputation.

-

Engage stakeholders: Companies should engage with stakeholders, such as employees, customers, investors, and regulators, to understand their ESG expectations and concerns. This will help the company to develop and implement ESG initiatives that are aligned with the needs of its stakeholders.

-

Develop and implement ESG initiatives: Once the company's ESG risks have been identified and assessed, it can develop and implement ESG initiatives to address these risks. These initiatives include investing in renewable energy, reducing waste, improving working conditions, and engaging with stakeholders.

-

Measure and report ESG performance: Companies should measure and report on their ESG performance on a regular basis. This will help them to track their progress, identify areas where they can improve, and communicate their ESG performance to stakeholders.

-

Adopt ESG best practices: Companies can adopt ESG best practices that are developed by organizations such as the Global Reporting Initiative (GRI) and the Sustainability Accounting Standards Board (SASB). These best practices can help companies to measure and report on their ESG performance in a consistent and transparent manner.

What is the concept of double materiality?

Double materiality is the idea that environmental and social impacts can be material to both a company's financial performance and long-term sustainability. The concept refers to how information disclosed by a company can be material both in terms of its implications for the company's financial value, as well as the company's impact on the world at large.

Double materiality is based on a recognition that a company’s impact on the world beyond purely financial considerations can be material and therefore should be disclosed, for reasons other than the effect on a company’s bottom line. Double materiality acknowledges that opportunities and risks can be material from both a financial and non-financial perspective. This is important because it means that companies need to consider both the potential financial impact of ESG issues as well as the potential long-term sustainability impact to them.

What are some of the environmental factors companies in Malaysia should consider?

Some of the environmental factors that manufacturing companies in Malaysia should consider are:

-

Air pollution: Manufacturing process can emit harmful pollutants into the air, such as particulate matter, nitrogen oxides, and sulphur dioxide. These pollutants can cause respiratory problems, heart disease, and other health problems.

-

Water pollution: Manufacturing companies can also pollute water bodies with chemicals, heavy metals, and other pollutants. This can contaminate drinking water, harm aquatic life, and damage ecosystems.

-

Waste generation: Manufacturing companies produce a lot of waste, including solid waste, hazardous waste, and wastewater. This waste can pollute the environment and pose a risk to human health.

-

Energy consumption: Manufacturing companies consume a lot of energy, which contributes to greenhouse gas emissions.

-

Climate change: Manufacturing companies are a major source of greenhouse gas (GHG) emissions, which contribute to climate change. Climate change can cause a variety of environmental problems, such as more extreme weather events, rising sea levels, and changes in agricultural yields.

What are some of the social factors companies in Malaysia should consider?

Some of the social factors that manufacturing companies in Malaysia should consider are:

-

Labour rights: Manufacturing companies should ensure that their employees have the right to safe working conditions, fair labour practices, and freedom of association. This means providing employees with a safe workplace, paying them a living wage, and allowing them to form unions and bargain collectively.

-

Community relations: Manufacturing companies should work with local communities to minimize the negative impacts of their operations and to

-

contribute to the local economy. This could involve things like providing job training programs for local residents, donating to local charities, or supporting local businesses.

-

Human rights: Manufacturing companies should avoid doing business with suppliers that violate human rights, such as child labour or forced labour. This means conducting due diligence on suppliers to ensure that they are not using these practices.

-

Sustainable sourcing: Manufacturing companies should source their materials from sustainable sources, such as recycled materials or materials that are produced in an environmentally friendly way. This could involve things like using recycled paper or plastic, or sourcing timber from sustainably managed forests.

-

Corporate social responsibility (CSR): Manufacturing companies should engage in corporate social responsibility (CSR) initiatives that benefit society, such as providing education and healthcare to employees and their families or supporting environmental conservation projects. This could involve things like building schools or hospitals, or funding environmental protection programs.

What are some of the governance factors companies in Malaysia should consider?

Some of the governance factors that manufacturing companies in Malaysia should consider are:

-

Board of directors: The board of directors is responsible for overseeing the company's management and ensuring that it is acting in the best interests of shareholders. The board should be made up of independent directors from diverse background who have the skills and experience necessary to oversee the company's operations.

-

Risk management: Manufacturing companies should have a robust risk management framework in place to identify, assess, and mitigate risks. This framework should be regularly reviewed and updated to ensure that it is effective in managing the company's risks.

-

Transparency: Manufacturing companies should be transparent about their operations and financial performance. This means providing timely and accurate information to shareholders, stakeholders, and the public.

-

Accountability: Manufacturing companies should be accountable for their actions. This means ensuring that they are held responsible for their decisions and performance.

-

Compliance: Manufacturing companies should comply with all applicable laws and regulations. This includes laws and regulations related to environmental protection, labour rights, and corporate social responsibility.

How can companies in Malaysia improve their ESG performance?

Manufacturing companies in Malaysia can improve their ESG performance by:

-

Setting ambitious ESG goals and targets: Manufacturing companies should set ambitious ESG goals and targets that are aligned with their overall business strategy and the Sustainable Development Goals (SDGs). These goals should be specific, measurable, achievable, relevant, and time-bound.

-

Investing in sustainable technologies: Manufacturing companies can invest in sustainable technologies to reduce their environmental impact and improve their energy efficiency. This could include investing in renewable energy sources, such as solar and wind power, or investing in energy-efficient machinery and equipment.

-

Adopting sustainable practices: Manufacturing companies can adopt sustainable practices throughout their operations, such as reducing waste, recycling materials, and using sustainable packaging. They can also work with suppliers to ensure that they are also adopting sustainable practices.

-

Being transparent about their ESG performance: Manufacturing companies should be transparent about their ESG performance by publishing regular reports on their sustainability initiatives and progress. This will help to build trust with stakeholders and demonstrate the company's commitment to ESG.

-

Engaging with stakeholders: Manufacturing companies should engage with stakeholders, such as employees, customers, investors, and regulators, to understand their ESG expectations and concerns. This will help the company to develop and implement ESG initiatives that are aligned with the needs of its stakeholders.

What are the specific regulations or guidelines related to ESG in Malaysia?

There are a few guidelines related to ESG in Malaysia such as:

-

Sustainability Reporting Guide

https://www.bursamalaysia.com/sites/5bb54be15f36ca0af339077a/content_entry5ce3b5005b711a1764454c1a/5ce3c83239fba2627b286508/files/bursa_malaysia_sustainability_reporting_guide-final.pdf?1570701456 -

Guidelines on Sustainable and Responsible Investment (SRI) Funds

https://www.sc.com.my/api/documentms/download.ashx?id=82073d55-faac-43e6-b43e-45abc234baed -

Malaysian Code on Corporate Governance

https://www.sc.com.my/api/documentms/download.ashx?id=239e5ea1-a258-4db8-a9e2-41c215bdb776 -

Green Practices Guideline for Manufacturing Sector

https://www.myhijau.my/ebook/pdf/mgtc.pdf

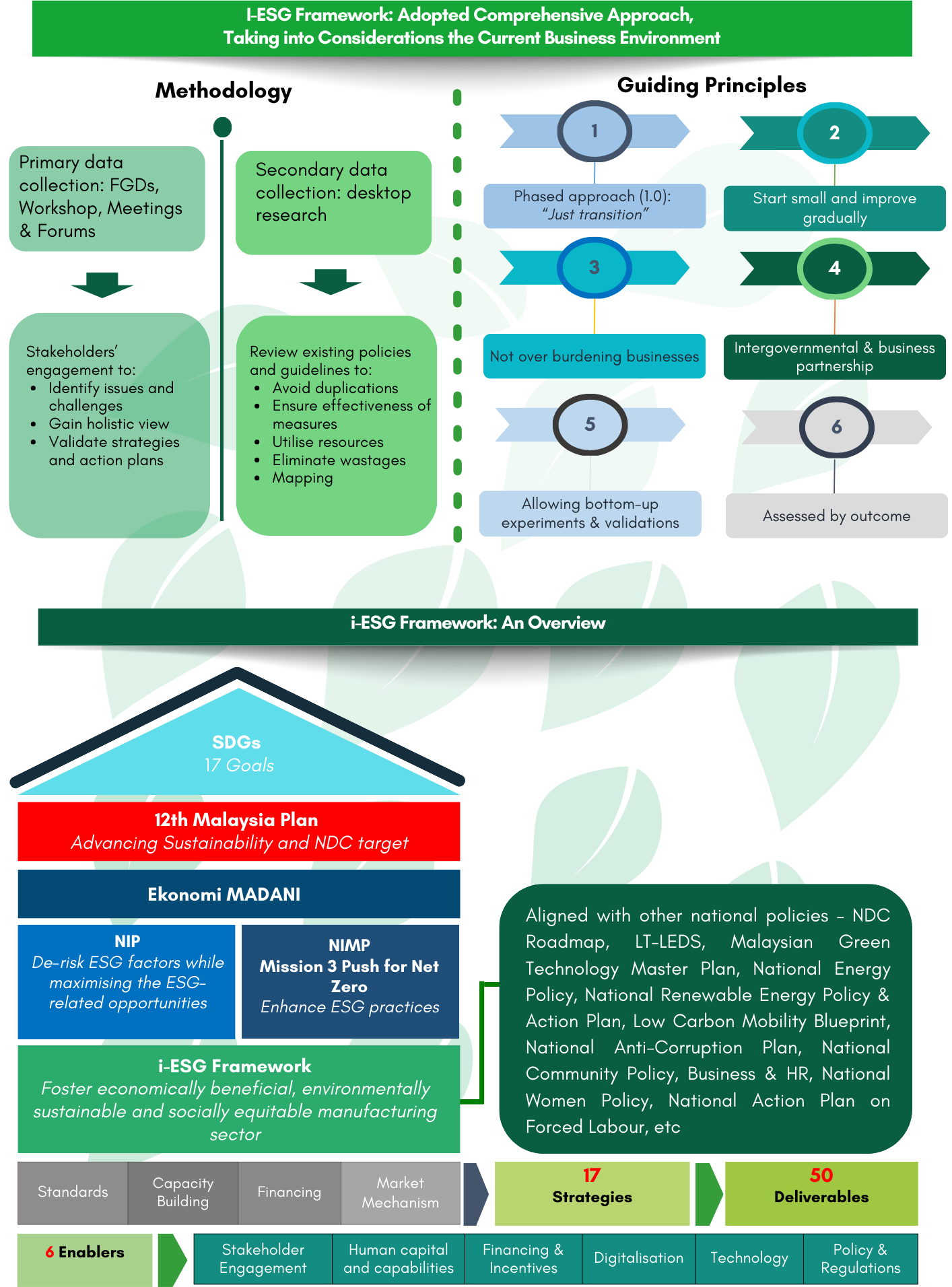

What are the current regulatory requirements for ESG reporting in Malaysia?

Currently ESG reporting is not mandated by the Government. However, commencing in financial year end (FYE) 2023, it will be compulsory for Public Listed Companies to disclose their Sustainability Statement in accordance with the Listing Requirements of Bursa Malaysia. Meanwhile, Financial Institutions will be required to comply with Bank Negara’s Climate Change and Principle-based Taxonomy (CCPT) by 2024.

Nevertheless, plan is underway for mandatory adoption of ESG practices for all businesses operating in Malaysia through phased approach. The first phase or the “just transition” phase will take place from 2024 to 2026. During this phase, companies are encouraged to adopt ESG practices to meet their stakeholders’ requirements as well as to be aligned with the Governments commitments towards achieving the 17 Global Goals and the net zero GHG emission by 2050. The second phase or the “acceleration” phase will take place from 2027 to 2030. During this phase, companies will be required to produce their sustainability reporting using any internationally recognized reporting standard of their own preference.

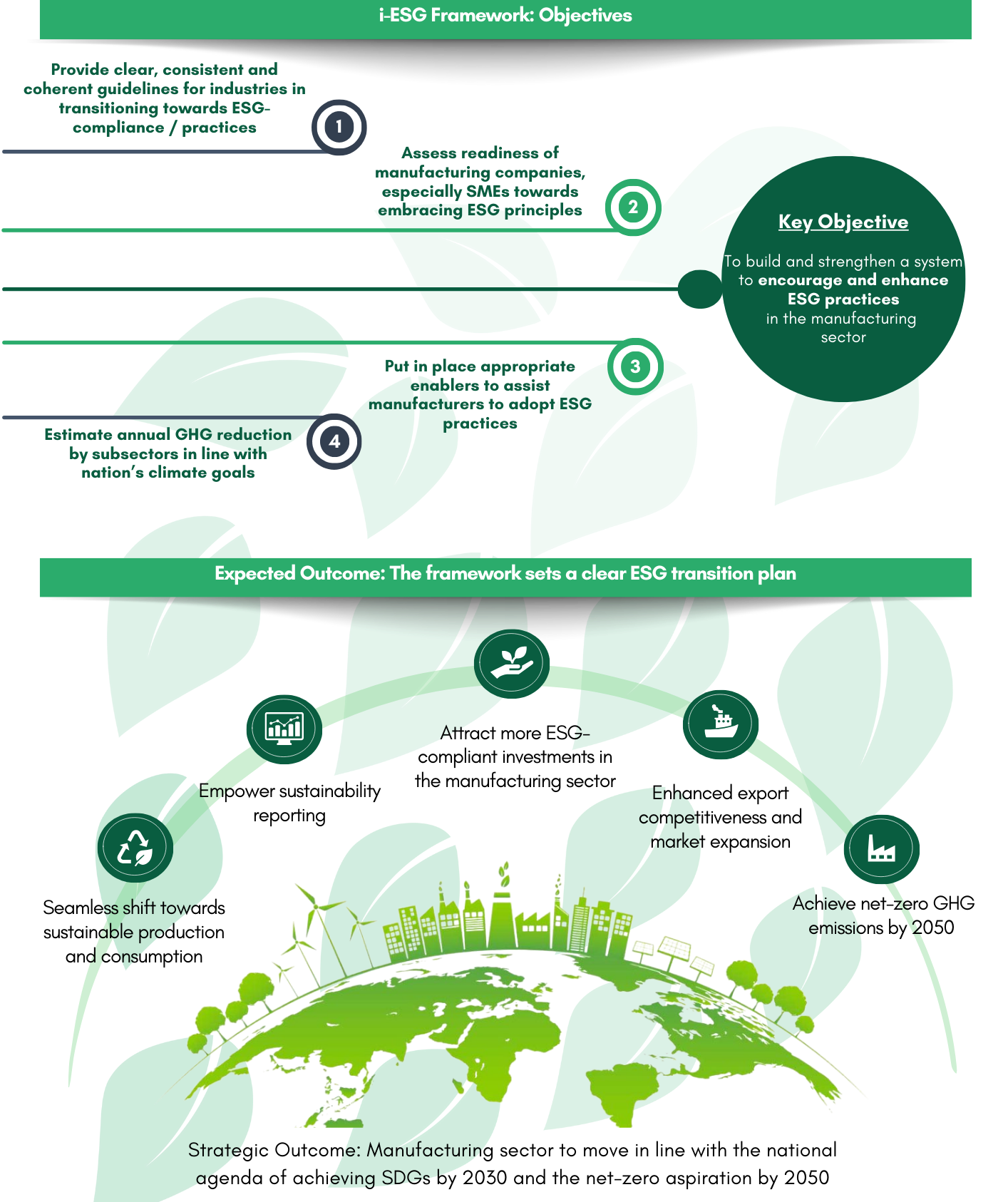

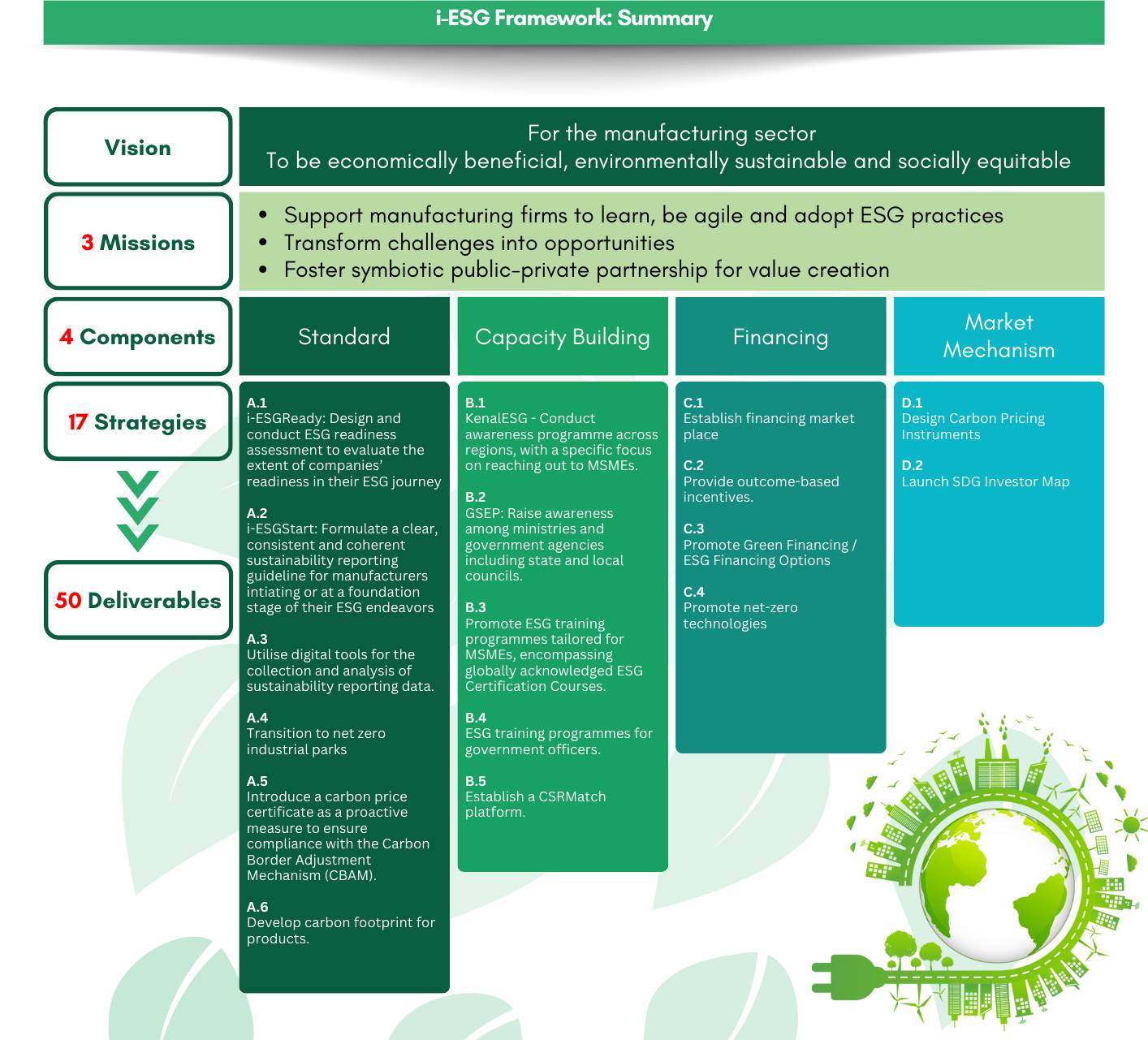

How will MITI assist manufacturing companies in Malaysia with their ESG adoption?

MITI is expecting to launch the Environmental, Social and Governance Framework for the Manufacturing Industry (i-ESG Framework) in the third quarter of 2023. The key objective of the Framework is to build and strengthen a system to encourage and enhance ESG practices in the manufacturing sector. The Framework aims to:

-

build and strengthen a system to encourage and enhance ESG practices in the manufacturing sector;

-

assess readiness of manufacturing companies, especially MSMEs towards embracing ESG principles;

-

put in place appropriate enablers to assist manufacturers to adopt ESG practices; and

-

estimate annual GHG reduction by subsectors in line with nation’s climate goals.

This Framework will support companies in Malaysia in their ESG compliance through four pillars which are standards, capacity building, financing and market mechanism. It will guide companies to assess their ESG-readiness, identify and set their ESG target, prioritize and take actions to be ESG compliant, track their ESG progress and finally report their ESG performance. This is a continuous process as it does not stop at reporting but companies have to keep assessing and reassessing their ESG level of compliance.

What are some ESG reporting standards that manufacturing companies in Malaysia could follow?

There are a number of ESG reporting standards that manufacturing companies in Malaysia could follow such as:

-

Global Reporting Initiative (GRI): The GRI is a non-profit organization that develops sustainability reporting guidelines for organizations around the world to use to measure and report on their environmental, social, and governance performance. The GRI's standards are used by over 10,000 organizations in over 160 countries.

https://www.globalreporting.org/ -

Sustainability Accounting Standards Board (SASB): The SASB is a non-profit organization that develops sustainability accounting standards for specific industries that companies can use to measure and report on their environmental, social, and governance performance. SASB's standards are used by over 500 companies in the United States.

https://sasb.org/ -

Task Force on Climate-related Financial Disclosures (TCFD): The TCFD is an international organization that developed recommendations for climate-related financial disclosures. The TCFD's recommendations are used by over 2,000 organizations around the world.

https://www.fsb-tcfd.org/ -

International Integrated Reporting Council (IIRC): The IIRC is an international organization that developed the International Integrated Reporting Framework (IIRC Framework). The IIRC Framework is a set of principles and guidelines that organizations can use to report on their economic, environmental, and social performance.

https://www.integratedreporting.org/ -

Climate Disclosure Standards Board (CDSB): The CDSB is an international consortium of business and environmental NGOs that are committed to advancing and aligning the global mainstream corporate reporting model to equate natural capital with financial capital. The CDSB offer companies a framework for reporting environmental information with the same rigour as financial information.

https://www.cdsb.net/index.html -

Carbon Disclosure Project (CDP): The CDP is a not-for-profit charity that runs the global disclosure system for investors, companies, cities, states and regions to manage their environmental impacts.

https://www.cdp.net/en

These are just a few of the ESG reporting standards that companies in Malaysia could follow. The best standard for a particular company will depend on its size, industry and other factors.

2024

2023

Home

Home

.png)