- Overview

- AP Category

- Motor Vehicles

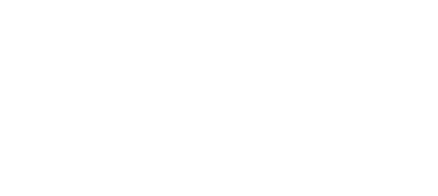

- Heavy Machinery

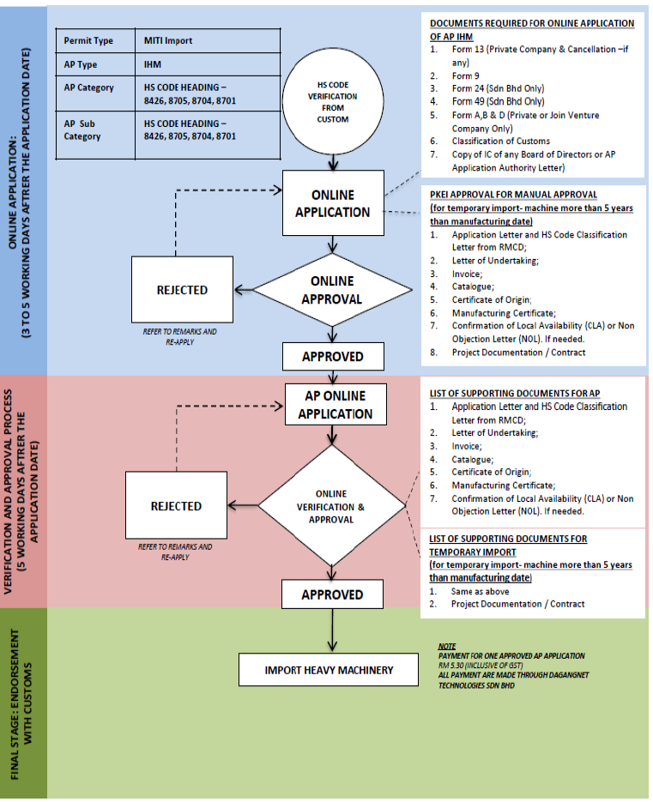

- CWC Chemicals

- Iron & Steel Products

- Other Goods

- Additional Reference & Fallout Procedures

- FAQ

- Contact Us

| WHAT IS APPROVED PERMIT (AP)? |

|

An Approved Permit (AP) is a document that allows for the import and export of goods. Ministry of Investment, Trade and Industry (MITI) issues APs with the objective to:

All APs under the control of MITI are enforced and issued based on the Customs Act 1967 under the Customs (Prohibition on Import and Export) Order, 2023. |

|

WHAT IS APPROVED PERMIT (AP)? |

||

|

WHICH CATEGORY AP ARE YOU? |

||

| Motor Vehicle AP |

Open AP |

|

|

Franchise AP |

|

|

|

Other Vehicle AP |

|

|

|

Individual AP |

|

|

| Heavy Machinery AP |

Heavy Machinery |

|

| Iron & Steel / CWC Chemicals AP |

Iron & Steel Product / CWC Chemical |

|

| Other Services |

|

|

| HOW TO APPLY AP? | ||

Electric Vehicles AP

Franchise AP

Open AP

Individual AP

Other Vehicles AP

Heavy Machinery Subject to AP

Types of Import

Import Conditions

Application Process

Guidelines

Checklist and Forms

Chemicals subject to AP

Types of Import

Checklist

Application Process

Guidelines

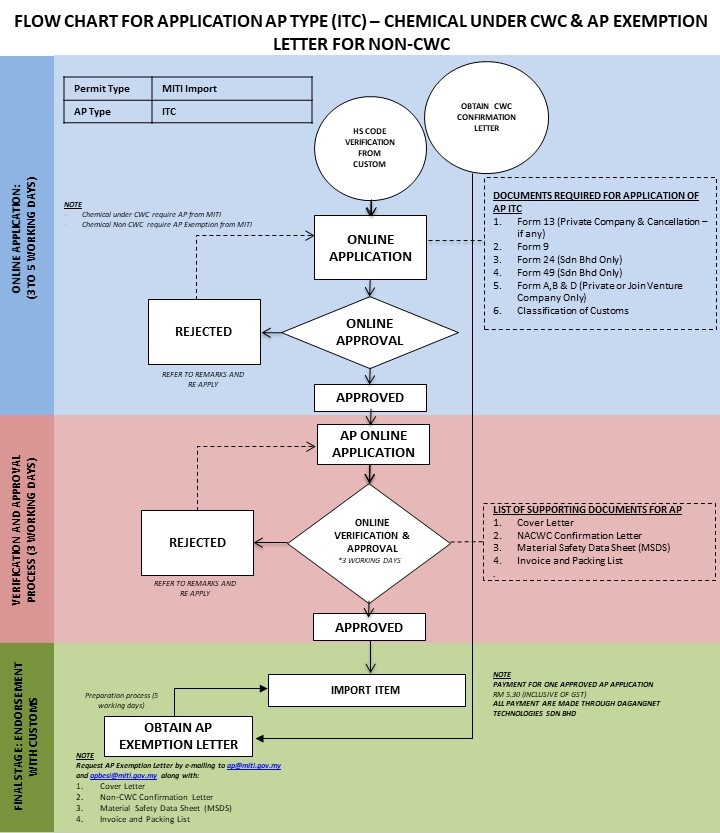

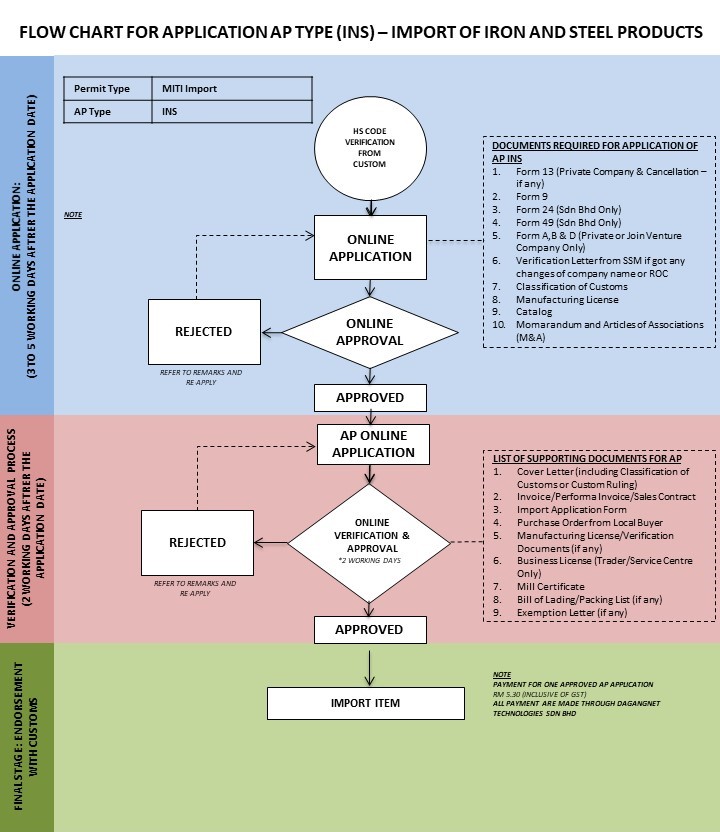

Import Iron and Steel Products Subject to AP

Export Waste and Scrap Subject to AP

Guidelines

Checklist and Forms

Application Flowchart

Importation of Batteries

What is Approved Permit (AP)?

Which products are subject to AP under MITI?

What about other products?

Where can I get the HS Code confirmation?

How can I confirm that the chemical I intend to import is subject to AP?

How long is the AP valid?

How much do I need to pay for the tax and duties?

Why Can’t I Register My Vehicle at JPJ Registration Counter?

|

Hotline / Appointments: |

|

|

Export and Import Control Section Tel : +603.8000.8000 Website : https://www.miti.gov.my |

For ePermit / system related issues: Dagang Net Techonologies Sdn Bhd Toll Free : 1300.133.133 Website : http://www.dagangnet.com |

|

AP Type |

|

|

Open AP |

apterbuka@miti.gov.my |

|

Franchise AP |

francaisap@miti.gov.my |

|

Other Vehicle AP |

apluarkuota@miti.gov.my |

|

Individual AP |

apluarkuota@miti.gov.my |

|

General Questions |

ap@miti.gov.my |

|

ePermit / System related issues |

careline@dagangnet.com |

Home

Home