by: Dato’ Sri Mustapa Mohamed

THE services sector is overtaking manufacturing as the main contributor to economic growth. This will have vast implications on where people are going to find work and what skills they will need to get employed.

The government’s growth target is very clear: To become a developed nation by 2020. Using a World Bank definition, that means having a per capita income of RM49,500 (US$15,000) by the end of the decade. The per capita income level in 2010 was RM23,100 (US$7,000).This is an ambitious target and requires gross domestic product (GDP) growth of at least 7 per cent per year.

Historically, the country’s growth had been led by manufacturing. But when the government reviewed its economic policy last year, it realised that this may not be the case for much longer.

For two reasons. In developed economies, the services sector is usually the biggest contributor to economic output.

Last year, services contributed to 77 per cent of the US’s GDP; 71 per cent of Germany’s; 74 per cent of Japan’s; 63 per cent of Singapore’s and 92 per cent of Hong Kong’s. In Malaysia, the figure was 58 per cent. This means there is plenty of room for the services sector to grow as the nation’s economy becomes more developed.

The second reason is more prosaic. Increasingly, many of Malaysia’s traditional competitive advantages in manufacturing - such as our low cost and the availability of skilled workers - are being matched by many emerging economies. The solution for us is to migrate to higher value-added and more technology and capital-intensive industries. That is happening, but will take time.

Meanwhile, new sources of growth will have to be found and the government has targeted the services sector to drive future growth. It is projecting that the sector’s share (inclusive of government services) of GDP will grow to 67.3 per cent by 2020. The government envisages that this growth will take place across the board, especially in oil and gas, construction, business and professional services, education and training, ICT, healthcare and tourism sectors.

Particular attention will be given to the development of so-called “backbone services”. These are the ones that contribute important inputs for the production and export of other services. Think software tools that we use to manage our airports; or the digital networks that enable us to use our handsets.To accelerate growth of the services industry, the government has opened up a number of important services sub-sectors to foreign participation. Allowing foreigners to own businesses here or in partnership with locals can help to upgrade the skills of Malaysians and also assist them to establish business links overseas.

Some of the liberalisation measures undertaken also meet obligations the country has signed up to under various trade agreements. Upon joining the World Trade Organisation in 1995, for example, we committed ourselves to liberalising a wide range of sectors in the services industry. Currently, we are in the Doha Round and once the round is concluded we would have liberalised 11 out of 12 major sectors.Our Asean commitments have also required us to progressively open up our domestic services market to participation from other Asean countries.

The targets and timelines we follow are according to the blueprint mapped out to establish the Asean Economic Community by 2015. To date, we have made liberalisation commitments in 96 services sub-sectors.

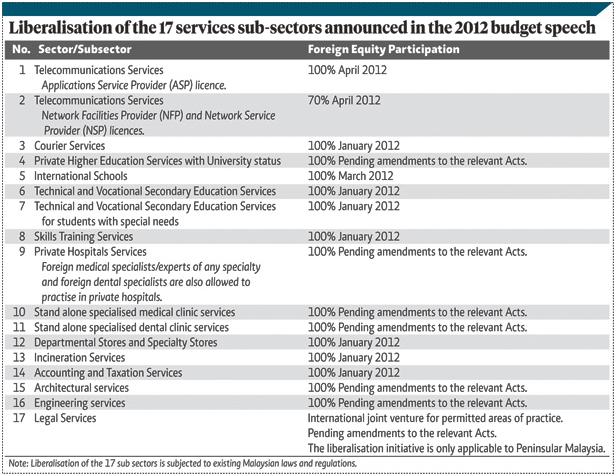

The government has also acted unilaterally to accelerate the pace of services liberalisation. In April 2009, 27 services sub-sectors were opened up. More substantive moves were announced in Parliament recently in the Prime Minister’s budget speech. An additional 17 sub-sectors will be opened up to foreign ownership in 2012. These changes allow foreigners to own up to 100 per cent of their local business. (See table)

The government has conducted extensive consultations with public and private stakeholders. Additionally, Ministry of International Trade and Industry is preparing a roadmap on the implementation of the liberalisation of the services sector.And for the first time, higher foreign equity participation in service areas, such as architecture, engineering, taxation and accounting services will be allowed. How is all this going to work out? An overseeing body, known as the Malaysia Services Development Council (MSDC), has been set up to monitor and coordinate the work of ministries implementing the liberalisation programme.

The MSDC will review rules and regulations that impede the growth of the industry and assist local players, mostly SMEs, to develop and export their services. The export potential of our services sector should not be underestimated. Last year, our services exports totalled a massive RM105 billion. Tourism is a significant contributor to this total. In 2010, 24.6 million tourists visited Malaysia, bringing in receipts amounting to RM56.5 billion. If we can attract more tourists from China, Europe and the Middle East, tourism’s contribution to GDP will grow.

Last year, our construction sector contributed exports valued at RM3.44 billion. The Middle East has been a favoured destination for Malaysian construction companies, and over the past few years, seven leading Malaysian companies have undertaken projects in Saudi Arabia, Sudan, Qatar, the UAE, Bahrain, Syria and also Oman, Yemen, Morocco and Yemen. We also expect that medical tourism will become an expanding industry in the years to come will have spillover effects on other sectors of the economy.

Our Islamic financial sector, too, is well developed and should continue to attract investors. Overall, we now have in place various initiatives to accelerate the pace of development of the services sector. Mida is working hard to bring in foreign investment in this sector while Matrade is helping our companies to export their services in selected industries. Locally, our own companies must take better advantage of the opportunities that are emerging in key services sectors of our economy as we roll out our Economic Transformation Programme.

If we can keep this pace up and stay focussed, I am confident we can meet the growth targets we have set for ourselves.

Datuk Seri Mustapa Mohamed is the Minister of International Trade and Industry.

The government’s growth target is very clear: To become a developed nation by 2020. Using a World Bank definition, that means having a per capita income of RM49,500 (US$15,000) by the end of the decade. The per capita income level in 2010 was RM23,100 (US$7,000).This is an ambitious target and requires gross domestic product (GDP) growth of at least 7 per cent per year.

Historically, the country’s growth had been led by manufacturing. But when the government reviewed its economic policy last year, it realised that this may not be the case for much longer.

For two reasons. In developed economies, the services sector is usually the biggest contributor to economic output.

Last year, services contributed to 77 per cent of the US’s GDP; 71 per cent of Germany’s; 74 per cent of Japan’s; 63 per cent of Singapore’s and 92 per cent of Hong Kong’s. In Malaysia, the figure was 58 per cent. This means there is plenty of room for the services sector to grow as the nation’s economy becomes more developed.

The second reason is more prosaic. Increasingly, many of Malaysia’s traditional competitive advantages in manufacturing - such as our low cost and the availability of skilled workers - are being matched by many emerging economies. The solution for us is to migrate to higher value-added and more technology and capital-intensive industries. That is happening, but will take time.

Meanwhile, new sources of growth will have to be found and the government has targeted the services sector to drive future growth. It is projecting that the sector’s share (inclusive of government services) of GDP will grow to 67.3 per cent by 2020. The government envisages that this growth will take place across the board, especially in oil and gas, construction, business and professional services, education and training, ICT, healthcare and tourism sectors.

Particular attention will be given to the development of so-called “backbone services”. These are the ones that contribute important inputs for the production and export of other services. Think software tools that we use to manage our airports; or the digital networks that enable us to use our handsets.To accelerate growth of the services industry, the government has opened up a number of important services sub-sectors to foreign participation. Allowing foreigners to own businesses here or in partnership with locals can help to upgrade the skills of Malaysians and also assist them to establish business links overseas.

Some of the liberalisation measures undertaken also meet obligations the country has signed up to under various trade agreements. Upon joining the World Trade Organisation in 1995, for example, we committed ourselves to liberalising a wide range of sectors in the services industry. Currently, we are in the Doha Round and once the round is concluded we would have liberalised 11 out of 12 major sectors.Our Asean commitments have also required us to progressively open up our domestic services market to participation from other Asean countries.

The targets and timelines we follow are according to the blueprint mapped out to establish the Asean Economic Community by 2015. To date, we have made liberalisation commitments in 96 services sub-sectors.

The government has also acted unilaterally to accelerate the pace of services liberalisation. In April 2009, 27 services sub-sectors were opened up. More substantive moves were announced in Parliament recently in the Prime Minister’s budget speech. An additional 17 sub-sectors will be opened up to foreign ownership in 2012. These changes allow foreigners to own up to 100 per cent of their local business. (See table)

The government has conducted extensive consultations with public and private stakeholders. Additionally, Ministry of International Trade and Industry is preparing a roadmap on the implementation of the liberalisation of the services sector.And for the first time, higher foreign equity participation in service areas, such as architecture, engineering, taxation and accounting services will be allowed. How is all this going to work out? An overseeing body, known as the Malaysia Services Development Council (MSDC), has been set up to monitor and coordinate the work of ministries implementing the liberalisation programme.

The MSDC will review rules and regulations that impede the growth of the industry and assist local players, mostly SMEs, to develop and export their services. The export potential of our services sector should not be underestimated. Last year, our services exports totalled a massive RM105 billion. Tourism is a significant contributor to this total. In 2010, 24.6 million tourists visited Malaysia, bringing in receipts amounting to RM56.5 billion. If we can attract more tourists from China, Europe and the Middle East, tourism’s contribution to GDP will grow.

Last year, our construction sector contributed exports valued at RM3.44 billion. The Middle East has been a favoured destination for Malaysian construction companies, and over the past few years, seven leading Malaysian companies have undertaken projects in Saudi Arabia, Sudan, Qatar, the UAE, Bahrain, Syria and also Oman, Yemen, Morocco and Yemen. We also expect that medical tourism will become an expanding industry in the years to come will have spillover effects on other sectors of the economy.

Our Islamic financial sector, too, is well developed and should continue to attract investors. Overall, we now have in place various initiatives to accelerate the pace of development of the services sector. Mida is working hard to bring in foreign investment in this sector while Matrade is helping our companies to export their services in selected industries. Locally, our own companies must take better advantage of the opportunities that are emerging in key services sectors of our economy as we roll out our Economic Transformation Programme.

If we can keep this pace up and stay focussed, I am confident we can meet the growth targets we have set for ourselves.

Datuk Seri Mustapa Mohamed is the Minister of International Trade and Industry.